UNFCCC Budget Shortfall: A Threat to Global Climate Negotiations

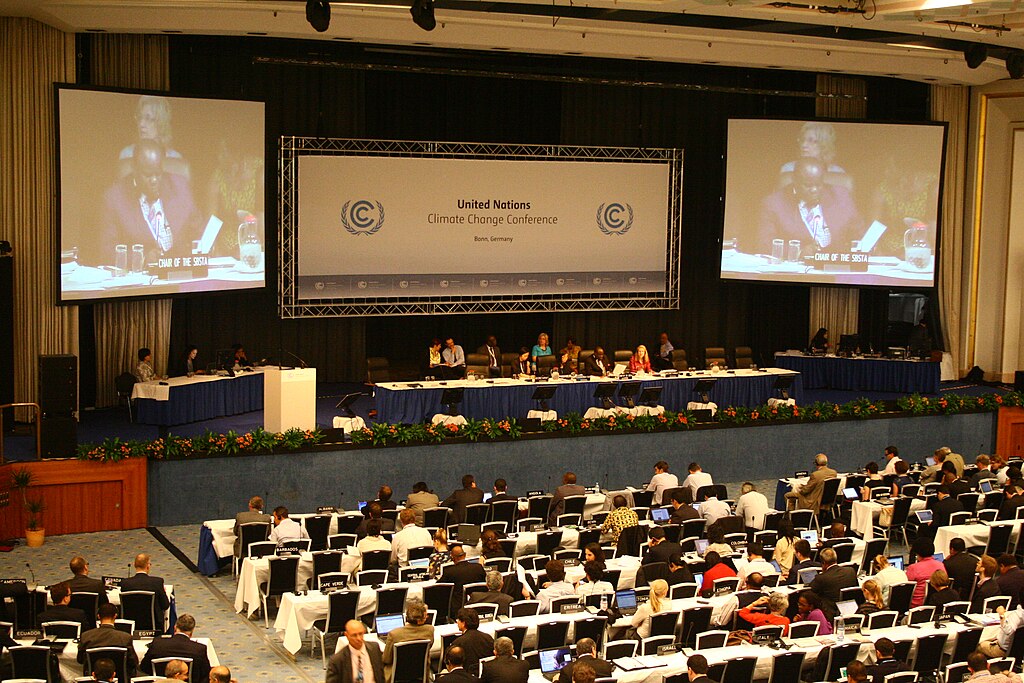

The United Nations Framework Convention on Climate Change (UNFCCC) is currently facing a budget shortfall of at least €57 million ($61.53 million) for 2024, according to a recent Reuters analysis. This funding gap jeopardizes international climate dialogues and the implementation of agreements among nearly 200 member countries.

Budget Overview

The UNFCCC's total budget for 2024-2025 is set at €240 million, half of which is allocated for this year. The budget comprises a core fund, a supplementary fund supported by voluntary donations, and a fund to assist delegates from developing nations. While countries like Japan and Germany have exceeded their payment obligations, the U.S. and China—two of the largest greenhouse gas emitters—have yet to fulfill theirs, with contributions due annually on January 1.

Impacts of the Shortfall

The budget crisis has forced the UNFCCC to curtail its activities, including reducing operational hours and canceling regional climate events that previously attracted substantial investment pledges. A spokesperson acknowledged that resources are increasingly stretched, hampering efforts to support vulnerable nations and maintain effective climate negotiations.

Delayed Contributions and Consequences

As of October, the UNFCCC had only received €63 million ($68 million) of the required funds for 2024. Although the U.S. and China have indicated they will meet their obligations, their contributions alone will not bridge the budget gap. Diplomatic sources express concern that this funding deficit could undermine critical climate actions and negotiations, particularly at the upcoming COP29 summit in Baku, Azerbaijan.

Conclusion

The UNFCCC's ability to facilitate global climate action is at risk without timely contributions from member nations. Strengthening financial commitments is essential to ensure effective dialogue and meaningful progress in the fight against climate change.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility