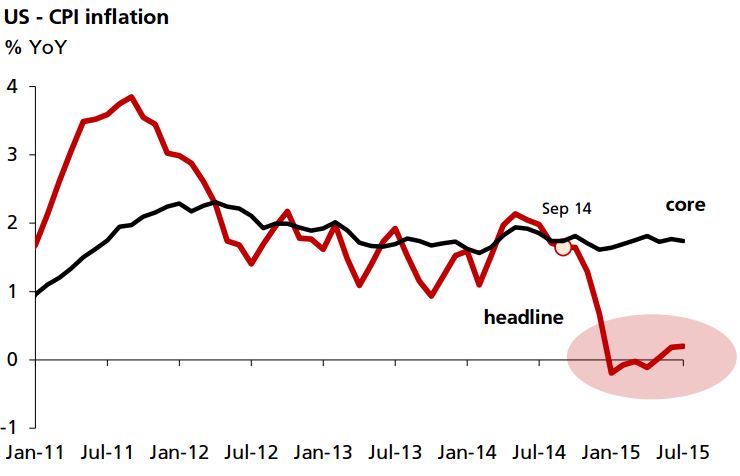

At least that what's markets expect for today's CPI report. Both core and headline prices are expected to advance by 0.2% (MoM, sa) in July, which would leave core on-year inflation at 1.8% YoY and lift the headline measure by a single tick to 0.2% YoY.

"We reckon the risk on both measures is for monthly rises of 0.1% instead, given the drop in crude prices (relative to the headline) and continued deflation in goods prices (relative to the core)," noted DBS Bank.

The Fed's favoured gauge - core PCE inflation - has been trickling lower for the past 3.5 years owing to goods price deflation and, more recently, to disinflation in the service sector. The latter is bound to spill over into CPI measures of inflation before long.

A couple of Fed officials - Lockhart and Bullard - sound anxious to proceed with liftoff. They will meet significant opposition, however, if inflation, particularly in the core, continues to run the wrong way.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022