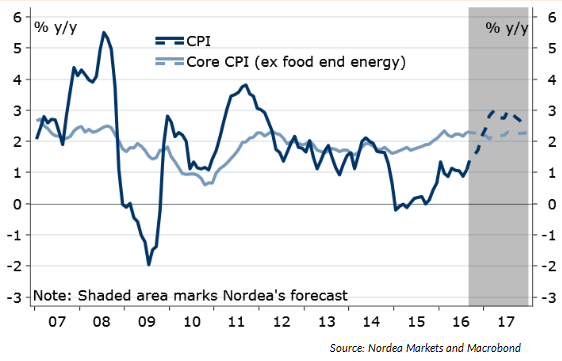

In September, U.S. headline CPI inflation started a rapid acceleration towards the above 2 percent rate, which is expected to reach around the end of 2016, noted Nordea Bank. In other words, the U.S. inflation expectations are anticipated to see a noticeable change in the months ahead. And while this is likely to affect expectations for Fed policy, the case for a steeper yield curve is also quite good.

The headline CPI inflation rate of the U.S. accelerated to 1.5 percent year-on-year in September, the highest since October 2014. It came in line with consensus expectations and rose from 1.1 percent in August. The rise was partially due to increased energy prices in the month and waning base effects from declining energy prices.

On a sequential basis, consumer prices rose 0.3 percent, on par with consensus projection and up from 0.2 percent in August. The monthly rise was driven by a 2.9 percent increase in energy costs. Meanwhile, core inflation rate dropped by 0.1 percentage points to 2.2 percent year-on-year in September, as compared with consensus expectations for it to remain at 2.3 percent.

However, because of signs in the recent PPI report of a rebound in core non-shelter services price inflation, core PCE inflation is likely to remain at a stable 1.7 percent rise in September, quite close to the central bank’s 2 percent target, stated Nordea Bank.

“Our headline CPI forecast, which incorporates a rising trend in oil prices, sees inflation rising from currently 1.5 percent y/y to well above 2 percent by end-2016 and close to 3 percent in H1 2017”, added Nordea Bank.

Even if prices of oil continue to be unchanged at the current level, the headline inflation is expected to accelerate sharply because of waning base effects from declining oil prices. The estimations based on assumed unchanged oil prices and sustained momentum in core prices indicates that the headline CPI would rise from current 1.5 percent year-on-year to 2.25 percent to 2.5 percent in the first half of 2017, according to Nordea Bank.

On the other hand, core inflation is likely to see widespread upward pressures on inflation, not least because the unit labor costs are increase at a pace of 2.5 percent year-on-year.

U.S. CPI inflation rises in September on energy prices, likely to rise above 2 pct by end-2016

Wednesday, October 19, 2016 6:11 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX