Samsung Electronics and SK hynix are expected to benefit from the U.S. government's plan to tighten regulations on Chinese legacy chips. The move aims to prohibit American defense companies from importing semiconductors from China. Securities analysts have predicted this development.

U.S. Department of Commerce Launches Survey

Last Thursday, the U.S. Department of Commerce announced its intention to conduct a survey in January. Korea Times reported that the survey will identify how American companies in critical industries source chips from China, specifically those with a size of 28 nanometers or larger.

According to the Korea Herald, The department aims to mitigate national security risks associated with China.

The upcoming measure is seen as a preemptive attempt to prevent Chinese firms from dominating the U.S. semiconductor market. This follows their success in the American steelmaking and solar power sectors.

The Korean government is monitoring the potential impacts of the U.S. restriction on domestic companies. The Ministry of Trade, Industry, and Energy stated that they have strengthened cooperation with the U.S. and other major countries, to stabilize the semiconductor supply chain.

Positive Outlook for Samsung and SK

Market observers anticipate that the U.S. restrictions will primarily affect the exports of Chinese chipmakers. On the other hand, Samsung and SK hynix are expected to benefit from increased sales of their stocks of legacy DRAMs and NAND flash chips.

Kim Dong-won, an analyst at KB Securities, predicts that American companies will reduce their reliance on Chinese products to avoid regulatory uncertainties. The forthcoming U.S. measure is believed to target YMTC, CXMT, and SMIC, potentially exempting Chinese Samsung and SK hynix factories.

The forthcoming regulation aims to restrict YMTC's share in the U.S. NAND flash market. This move is expected to contribute to the growth of Samsung and SK's NAND businesses during the second half of next year.

China's foreign ministry spokesman, Wang Wenbing, expressed criticism towards the U.S., accusing it of "weaponizing" trade issues. China urges the U.S. to respect international trade regulations.

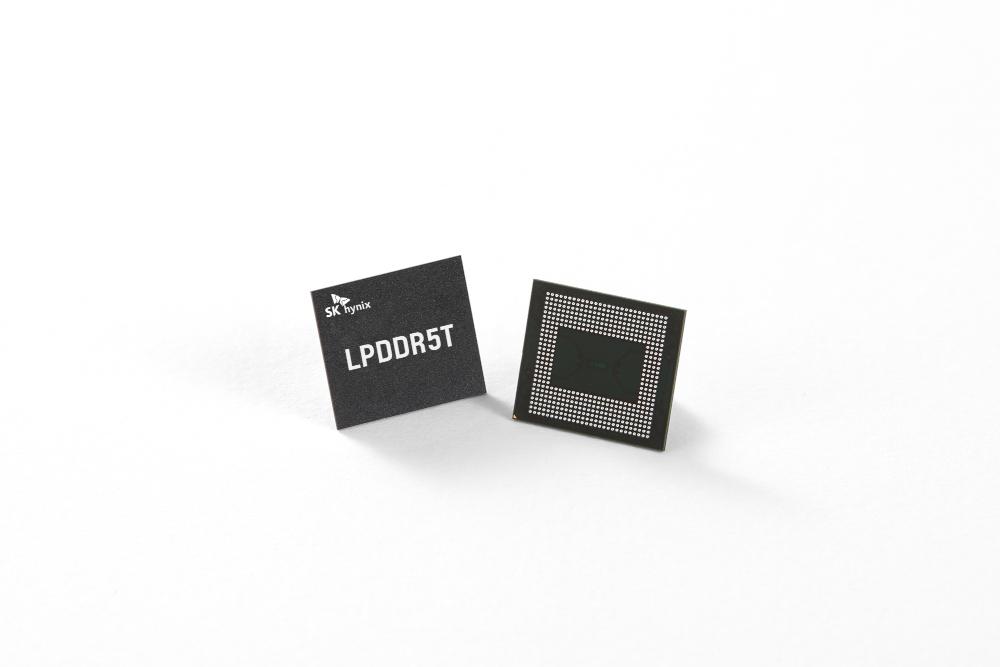

Photo: SK Hynix Newsroom

OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War

OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War  Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade  OpenAI Secures $110 Billion Funding Round at $840 Billion Valuation Ahead of IPO

OpenAI Secures $110 Billion Funding Round at $840 Billion Valuation Ahead of IPO  Nintendo Share Sale: MUFG and Bank of Kyoto to Sell Stakes in Strategic Unwinding

Nintendo Share Sale: MUFG and Bank of Kyoto to Sell Stakes in Strategic Unwinding  Netflix Declines to Raise Bid for Warner Bros. Discovery Amid Competing Paramount Skydance Offer

Netflix Declines to Raise Bid for Warner Bros. Discovery Amid Competing Paramount Skydance Offer  Malta will gain from smart heritage

Malta will gain from smart heritage  FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications

FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications  Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates

Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates  Meta Encryption Plan Sparks Child Safety Concerns Amid New Mexico Lawsuit

Meta Encryption Plan Sparks Child Safety Concerns Amid New Mexico Lawsuit  Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom

Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom  Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology

Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology  Synopsys Q2 Revenue Forecast Misses Expectations Amid China Export Curbs and AI Shift

Synopsys Q2 Revenue Forecast Misses Expectations Amid China Export Curbs and AI Shift  Pentagon Weighs Supply Chain Risk Designation for Anthropic Over Claude AI Use

Pentagon Weighs Supply Chain Risk Designation for Anthropic Over Claude AI Use  AWS Data Center in UAE Hit by Fire After Objects Strike Facility Amid Regional Tensions

AWS Data Center in UAE Hit by Fire After Objects Strike Facility Amid Regional Tensions  Snowflake Forecasts Strong Fiscal 2027 Revenue Growth as Enterprise AI Demand Surges

Snowflake Forecasts Strong Fiscal 2027 Revenue Growth as Enterprise AI Demand Surges  Qantas Shares Plunge 10% as Iran Strikes Send Oil Prices Soaring and Disrupt Global Flights

Qantas Shares Plunge 10% as Iran Strikes Send Oil Prices Soaring and Disrupt Global Flights