Barclays notes:

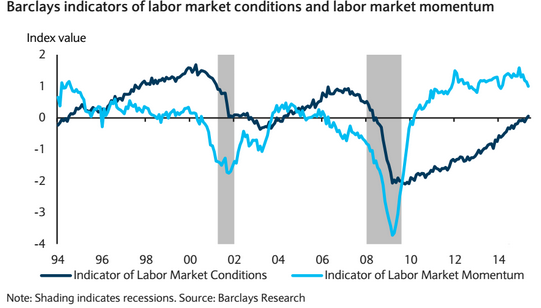

The Barclays Indicator of Labour Market Conditions and the Barclays Indicator of Labour Market Momentum show that conditions and momentum in labour markets rebounded in May.

Trends in both indicators remain positive and, together with our economic outlook, suggest that labour market conditions have reached their average level of activity since 1994. Further improvement from current levels would result in above-average conditions.

The Barclays Indicator of Labour Market Conditions rose 0.07pts to, 0.05, in May. The Barclays Indicator of Labour Market Momentum fell 0.14pts, to 1.00, the lowest reading since February 2014. Because both are normalized to have a mean of zero and standard deviation equal to one, these readings suggest that labour market conditions are equal to their average level over the two-decade sample period, while labour market momentum is now one standard deviation above its average since 1994.

The Barclays Indicator of Labour Market Conditions was boosted by stronger participation, the decline in initial claims (in % of private employment), a reduction in long-term unemployment, a narrower spread between the underemployment and unemployment rates, and NFIB data on hiring intentions and hard-to-fill positions. Momentum was slowed principally by the reduction in the cyclical portion of labour force participation, average weekly hours, and average hourly earnings.

In the 1994-95 and 2004-06 tightening cycles, increases in the federal funds rate coincided with positive values on the Barclays Indicator of Labour Market Conditions, when labour market activity was at average to above-average levels.

If indicators improve in line with recent trends, labour market activity should begin to exceed its average level of the past two decades and is consistent with our forecast for a September rate hike.

US Labour market conditions have normalized

Tuesday, June 9, 2015 9:43 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022