The fundamental outlook for US new home sales is very bullish in our view. Although young households are showing a clear preference towards renting rather than buying, tightness in rental inventories and the resulting rent inflation should encourage young households to turn to homeownership.

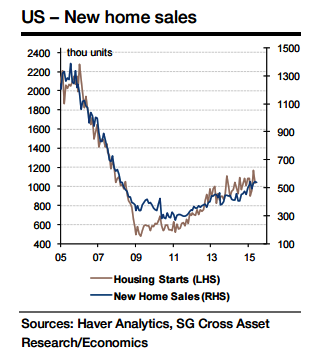

"After reaching an eight-year high in May, it is expected that new home sales decline modestly to 535k units. The forecast for a modest correction is driven by the reported decline in housing starts in June given the close correlation between the two series", says Societe Generale.

This is already evident in the resale activity where the ratio of first-time homebuyers has been rising steadily. But the inventory situation in the resale market has been fully normalized and this segment of the housing market is not capable of meeting demand.

This is why new home sales are expected to outperform going forward and to ultimately drive further gains in construction activity.

US New home sales to take a breather after reaching an eight-year high

Monday, July 20, 2015 3:58 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX