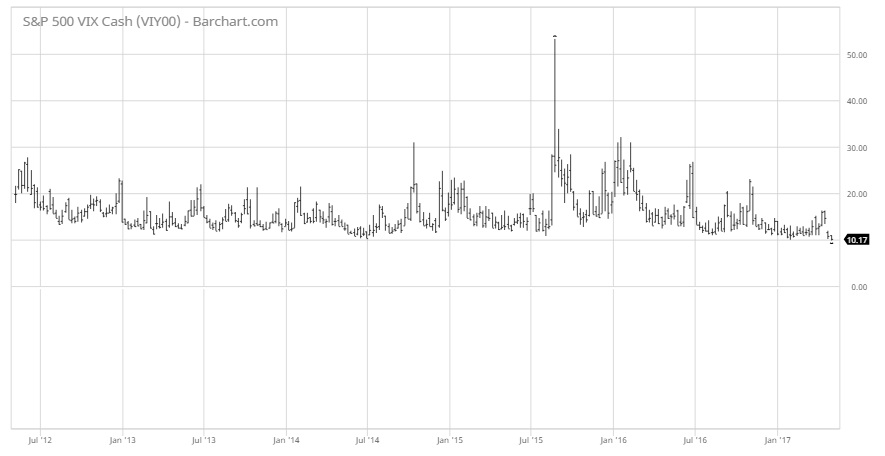

Chicago Board of Options Exchange’s implied volatility index, popularly known as simply VIX index has touched the lowest point since February 2007 as the US stock indices grind higher. Over the past six trading days, the tech-heavy index NASDAQ has been breaking into record highs consecutively. While the US benchmark stock index S&P 500 didn’t break into a new record high but flirting nearby.

Since 2016, except for occasional spikes, the VIX has been grinding lower despite an increase in geopolitical tensions across the United States. On Monday, VIX dipped below 10 for the first time since February 2007, and touched as low as 9.90, as it declined more than 9 percent. Currently, it is at 10.2, which is almost 50 percent below its long-term average 20. The last major spike in the VIX was back in early 2016 when it touched above 40 on Chinese currency devaluation. This year VIX has averaged around 12 as the S&P 500 returned close to 7 percent and NASDAQ returned 13 percent.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed