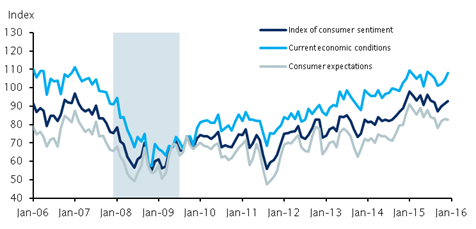

The University of Michigan index of consumer sentiment was revised up to 92.6 in the final December estimate (prelim: 91.8), modestly above expectations of 92.0. The current conditions index was revised up to 108.1 (initial: 107.0), the highest reading since June.

Consumer expectations were revised up a touch to 82.7 (initial: 82.0), below the November print (82.9) but still higher than October (82.1). Both revisions were driven by questions related to personal finances; the current personal finances index rose to 113 (initial: 111, previous: 111), and expected personal finances moved up to 124 (initial: 122, previous: 127).

Buying conditions for durables now stand at 167 (previous: 154), the highest since 2005 and consistent with continued strength in motor vehicle sales.

"Consumer sentiment stands in line with its average pace of improvement over the course of the recovery, and we expect household consumption will continue to drive growth in 2016", says Barclays.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed