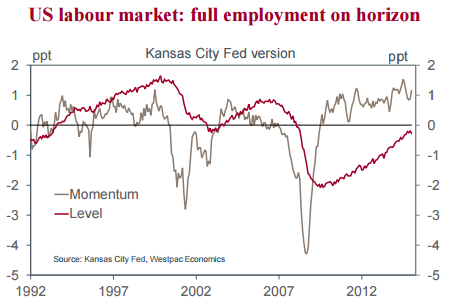

The 'Labor Market Conditions Indicators' (LMCI), compiled by the Kansas City Federal Reserve, have continued to point to steady, robust momentum in jobs growth and a consequent erosion of residual slack over the past five years. This impetus continued into the second half of 2015, with another solid employment outcome reported for July. The 215k gain for nonfarm payrolls, together with +14k in back revisions to May and June, broadly met the market's expectations. The July outcome is also in line with the year-to-date average of 211k, and implies annualised jobs growth of 1.8%, well in excess of reported population growth over the same period - 1.3% annualised, as per the household survey.

At just 5.3%, the unemployment rate is currently at its cycle low and is also broadly in line with FOMC expectations for full employment - as per their 'longer-run' central tendency forecasts which, as at the June FOMC meeting, stood at 5.0-5.2%. That the unemployment rate is at its cycle low is not to say that concerns over residual slack have vanished altogether. In aggregate terms, evidence of residual slack is most apparent in the employment-to-population ratio. It has only risen a percentage point in almost five years - a stark contrast to the near five percentage point reduction in the unemployment rate. This divergence is the result of historically weak participation, with the participation rate being at lows back to the late-1970's.

Much of the weakness in participation is the result of lower work force involvement amongst young and prime-aged workers. This is in contrast to those entering or heading towards retirement who remain highly engaged with the labour market. The trend amongst younger cohorts is concerning not only for aggregate momentum in the present (given young and prime-aged workers historic out-sized contribution to household consumption), but also future productive capacity, which depends on individuals' development of skills and knowledge and the building up of wealth over a lifetime. The FOMC is not ignoring weak participation, nor the potential immediate and/or long-term consequences. At the same time, arguably they do not believe that the now five-year long trend is likely to immediately reverse, rapidly increasing available slack.

Seeking to balance both their full employment and inflation mandates, the Committee see now as being an opportune time to begin the normalisation process. A modest pace of rate increases as the data dictates should not preclude further solid job and wage gains. And, given the low participation of younger workers, both outcomes should encourage greater participation from those outside of the labour market. If all goes well, these outcomes will help the available work force to remain fully employed while precluding a build-up in wage pressures and unit labour costs.

US employment, focus on momentum

Monday, August 10, 2015 1:14 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX