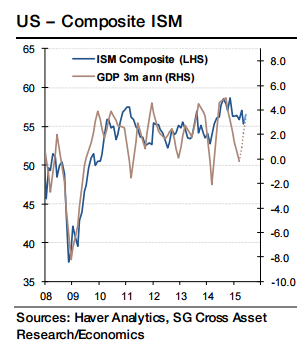

The US manufacturing ISM report released last week suggests that the factory sector is rebounding from its earlier weakness. The non-manufacturing ISM index has fared much better all along and is expected to remain at a level consistent with strong GDP growth.

"We project a 1.2 point increase in June to 56.9 which would reverse about 50% of May's decline and keep the composite well within its recent ranges",says Societe Generale

The outperformance of the service sector can be explained by two factors: minimal sensitivity to the dollar's strength and more limited spillover from the weakness in oil & gas investments. These factors have been weighing on manufacturing activity but should begin to dissipate in the coming months.

Weak consumer demand was also a factor supressing demand for both goods and services in Q1, but this is now reversing. The 56.9 forecast for the non-manufacturing ISM would put the composite of the two surveys at 56.5. This is consistent with GDP growth of 3.5%, close to the 3.3% forecast for second quarter growth.

US non-manufacturing ISM to rise modestly

Sunday, July 5, 2015 11:16 PM UTC

Editor's Picks

- Market Data

Most Popular