Headwinds to U.S. growth emanating from the soft global economic backdrop and elevated greenback were one of the motivations behind the Fed's decision not to raise rates in September. As we kick off October, these risks continue to loom and were highly apparent in this week's trade, manufacturing and employment data.

The advance report on U.S. international trade in goods - the new monthly indicator released on Tuesday - showed a dramatic deterioration in the merchandise trade balance in August, with the deficit widening from $59.1B to $67.2B. A combination of the strong dollar and subdued global demand weighed on exports, which fell by 3.5% m/m, marking the biggest decline since January. Meanwhile, imports gained 1.8% m/m, underscoring a comparatively robust level of domestic demand. While trade data will likely perform better next month, the extent of deterioration in the trade deficit in August suggests that the external sector will be a major drag on the U.S. growth in the third quarter.

The somber outlook for the global economy was reiterated this week, with the head of the IMF, Christine Lagarde, warning on Wednesday that global growth remains "disappointing and uneven". Global manufacturing activity largely reflected this assessment. Softness in PMI indicators across several economies increased the likelihood that the global economy could weaken further. India's manufacturing PMI hit a seven-month low in September, while those of South Korea and China remained stuck in contractionary territory. Eurozone manufacturing activity continued to expand; however, the PMI index slipped lower by 0.3 points, indicating a slightly slower pace of expansion.

Similarly, the U.S. ISM manufacturing index also fell, declining by 0.9 points to 50.2 in September and narrowly avoiding slipping into contractionary territory. The weakness was broad-based, with most sub-components and industries faring worse. However, perhaps most disconcerting was the deterioration in the forward-looking indicators suggesting that activity will likely remain subdued in the months ahead.

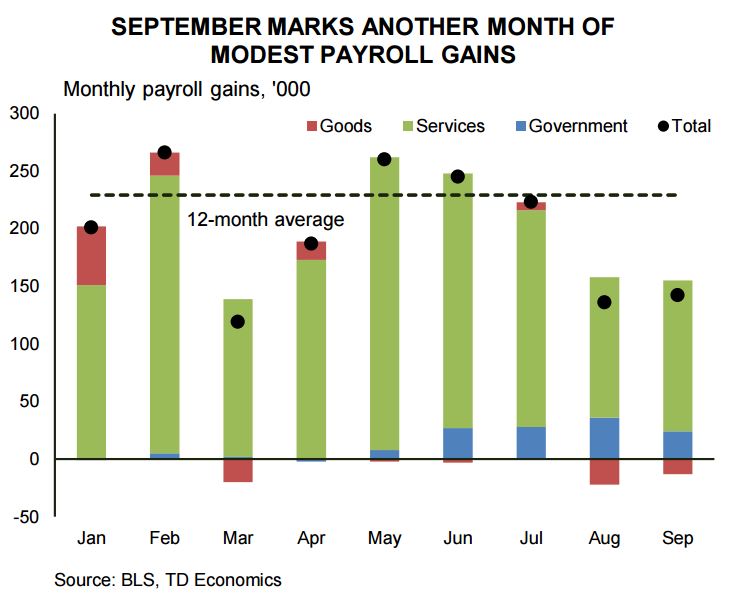

The trail of the global slowdown was also evident in September's non-farm payrolls, which rose by just 142k - the slowest pace of job creation since March. Manufacturing employment fell for a second consecutive month, while mining employment contracted for the ninth straight month. While the brunt of the losses was concentrated in these externally exposed industries, service sectors employment growth also softened to 131k from the 205k average over the last twelve months. Market reaction was swift, with 10-year Treasury yields falling by 18 basis points and expectations of the Fed hike being pushed to March.

The knee-jerk market reaction seems to be overdone. The slowdown in job creation cannot be chalked up to external factors exclusively. As the jobless rate is already beginning to approach its long-term trend level, job creation should naturally decelerate from its previous above-trend pace. It is worth noting that age-specific participation rates have remained relatively stable. With population aging, trend labor force growth is expected to be only about 80k a month. As a result, future expectations about job growth should reflect these factors.

Despite the looming global risks and slowing employment gains, the story remains positive for domestically-oriented sectors due to rising employment, low gasoline prices and improving real income.

Consumer confidence and spending continued to make strides over the last two months, both outstripping market. Ditto for light vehicle sales, which surged to 18.06 million in September - the highest pace of sales since 2005. Tailwinds from rising employment and incomes will continue to shore up consumer confidence and spending, with the latter poised to sustain an above-3% pace through the rest of the year.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply

Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply  Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume

Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume  KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking

KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking  China Factory Activity Surges to Five-Year High as Demand Boosts Manufacturing PMI

China Factory Activity Surges to Five-Year High as Demand Boosts Manufacturing PMI  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dollar Gains as Middle East Conflict Boosts Safe-Haven Demand, Oil Prices and Inflation Concerns Rise

Dollar Gains as Middle East Conflict Boosts Safe-Haven Demand, Oil Prices and Inflation Concerns Rise  Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply

Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply  Asian Markets Slide as Middle East Conflict Sparks Oil Price Surge and Inflation Fears

Asian Markets Slide as Middle East Conflict Sparks Oil Price Surge and Inflation Fears  U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns

U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns  U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns

U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns