The July FOMC statement upgraded the assessment of the labor market, noting that "some" further improvement is needed before beginning the hiking cycle. Separately, the Fed staff's expected path of the hiking cycle looks more realistic than what the market is pricing in and maintain the view that the front end is vulnerable to a modest repricing higher in yields.

"We maintain our recommendation of ffz5-z6 curve steepeners, long 6m3y risk reversals, and 3m5y-3m30y conditional bear-flatteners," says Barclays.

US Treasury yields were largely unchanged over the week, as economic data were broadly in line with expectations, equity markets stabilized and the July FOMC statement did little to sway investor perception about the start date of the hiking cycle.

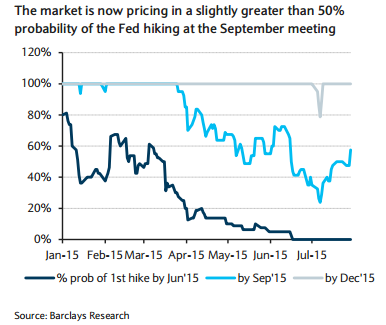

As expected, the July FOMC meeting statement did not provide a clear signal regarding the start of the hiking cycle. With key data in the form of the Q2 ECI print and the two employment and PCE inflation reports still to come before the next meeting, a September hike is clearly on the table and is a good base case if data continue to track what is viewed as fairly modest expectations. However, the decision to hike is clearly data dependent, and there is little reason for the Fed to commit to a September hike right now. The market is now pricing in a slightly greater than 50% probability of a September hike, which is reasonable as the Fed statement did suggest that normalization is getting close.

US rates: Weekly review

Thursday, July 30, 2015 11:27 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX