The last few weeks have seen the US yield curve 'twist'. While shorter-dated yields are little changed, longer-dated yields have fallen. Declines in commodity prices have reduced inflation expectations, reinforcing the view policy tightening will be gradual. The fall in Chinese equities and global markets more generally have fuelled concerns about global growth, prompting a move into safe haven assets. Markets now attach less than a 50% probability to a rate hike at the next FOMC meeting on 17th September. This is an underestimate and, while it is a close call, still expect the Fed to move at that meeting.

Recent data show that US economic growth has picked up. The initial estimate of Q2 GDP growth was 2.3% (ann) and subsequent data indicate that this is likely to be revised up. In addition, June inflation data showed the 'core' rate remaining stable and headline inflation rebounding, as the impact of the oil price decline around the turn of the year peaked. In its July statement the FOMC noted that it wished to see "some further improvement" in the labour market before it starts to raise interest rates. Subsequently one FOMC member, Fed Atlanta President Lockhart, stated that he will vote for a September rise unless the economic data deteriorates. This is particularly significant, as Lockhart is a "centrist" and likely bell-whether of consensus opinion on the Committee.

July payrolls data clearly meet the Fed's criteria for a September move. The one remaining payroll report before then is very important. The FOMC needs to weigh up strength of domestic activity against the impact of the renewed slide in oil prices, and the recent volatility in global markets.

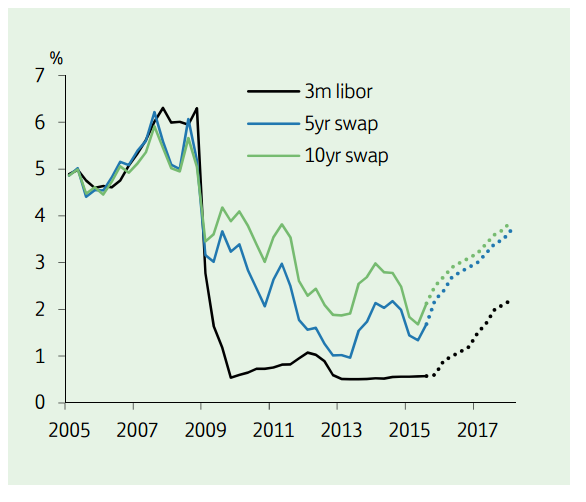

"We expect a September hike. If realised this would likely put upward pressure on bond yields, although the extent of any sell-off may be tempered by expectations that the pace of further tightening will be gradual. We forecast 10yr yields at 2.6% by end 2015 and 3.0% by end 2016," says Lloyds Bank.

US rates review

Wednesday, August 12, 2015 11:56 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022