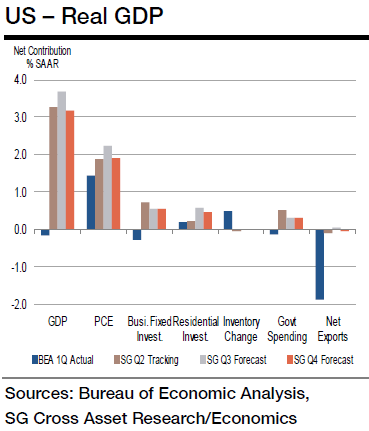

US real GDP and real consumption spending data for Q2 is likely to release on 30th July. The two macroeconomic indicators posted -0.2% and 2.1% growth respectively in Q1.

Societe Generale estimates, the real GDP growth is likely to post 3.3% growth and real consumption spending to post 2.8% in Q2. Therefore, the bank expects the real business activity probably rebounded sharply in Q2, after a weather-related contraction during the winter.

"Moreover, anticipated snapbacks in business fixed investment and government outlays, combined with a significantly smaller drag on growth from the external sector, likely fueled a 3.3% annualized rise in real GDP, following a 0.2% prior-period dip. The GDP chain-weighted price index likely increased by 1.9%, while the annualized growth of the Bureau of Economic Analysis' (BEA) core consumer inflation measure doubled to 1.6%, estimates SocGen.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed