USD/CAD slipped towards 1.3855 levels during the early European session, after the pair found resistance at 1.3959, before pulling back towards 1.3888 levels on falling oil prices.

- The pair continues to retain its bullish momentum, as the falling oil prices is set weigh on the Canadian dollar.

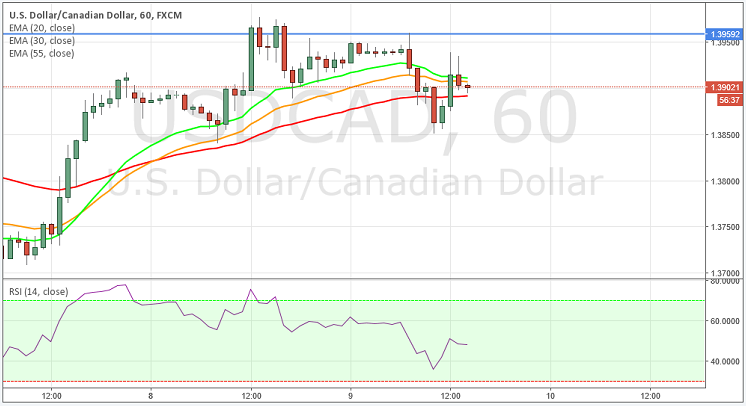

- Technically in 1 hours chart the 55, 30 and 20 MA's slightly pointing towards upside, meanwhile strength index is turning up. Overall the indicators are depicting more bullish movement for this pair.

- To the upside, the strong resistance can be seen at 1.3959, a break above this level would expose the pair towards 1.4036 levels.

- To the downside immediate support can be seen at 1.3880, a break below at this level will open the door towards next level at 1.3730.

Recommendation: Go long around 1.3770, targets around 1.3900/1.4000, SL 1.3700

Support levels: S1-1.3880, S2- 1.3730, S3-1 1.3634

Resistance levels: R1-1.3959, R2- 1.4036, R3- 1.4104