RBC Capital Markets notes:

The market's split expectations for next week's BoC decision suggest that we should see a significant CAD reaction whether the Bank cuts or not. But the main thing to keep in mind is that the two most likely scenarios-that they cut and leave a soft dovish bias, or don't cut and leave a very strong signal that they will likely do so soon-suggest an asymmetric risk lower for the currency. That is to say, a cut next week should see USD/CAD decently and sustainably higher, while no cut with a strong dovish signal would likely see a smaller dip that does not last long.

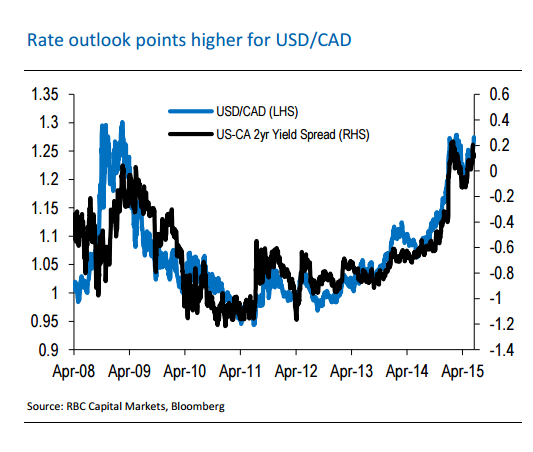

Moreover, in either case we still expect USD/CAD to be higher one to two months from now. The reason for that comes down to two key issues: 1) on the CA side, what's important is what is priced in for the coming months, not just next week; and 2) USD/CAD should really be a rate spread story in the coming months, and we expect the US side of the equation to do a lot of the heavy lifting.

With respect to the first issue, both of the most likely scenarios next week suggest lower rates in the coming months, which is already in the forward curve. That means that even if the Bank doesn't cut, short end rates should be anchored by a strongly dovish bias, and the rally in CAD should be fairly short-lived.

With regard to the second issue, the recent push back in expectations for the first Fed hike to Q1 2016 seems to be about as far as justified. Moreover, the US economy is still looking robust for the rest of the year, so with any settling of international concerns, the risk appears to be for an earlier hike than is priced.

USD/CAD outlook

Friday, July 10, 2015 2:22 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022