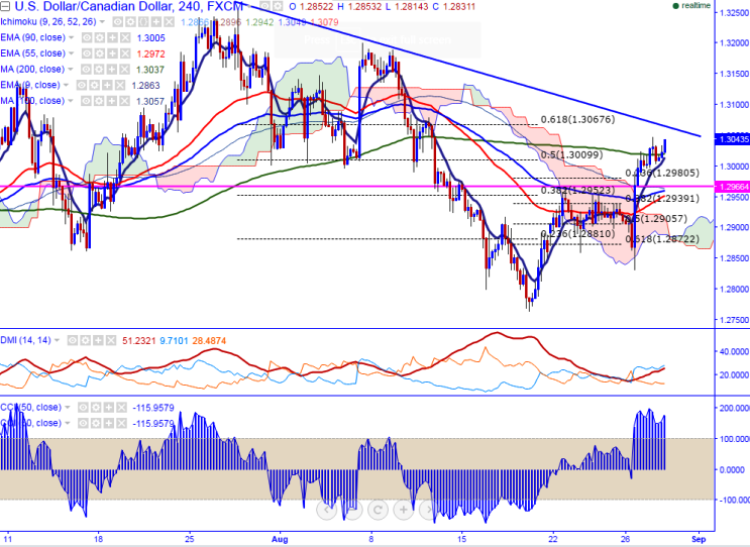

- Major resistance- 1.3020 (200- 4H MA).

- Major support -1.3000 (4H Tenken-Sen).

- Loonie has broken major resistance 1.3020 and jumped till 1.30474 yesterday. It is currently trading around 1.30375.

- Short term trend is bullish as long as support 1.2980 (23.6% retracement of 1.2760 and 1.30475).

- Any close above 200- 4H MA confirms major trend reversal, a jump till 1.3200 is possible.

- In 4H chart USD/CAD is trading well above Tenkan-Sen and Kijun-Sen and this confirms slight bullishness. The major resistance is around 1.3066 (61.8% retracement of 1.32541 and 1.27638) and any break above targets 1.3100/1.3147/1.3200.

- On the lower side, any break below 1.3000 (4H Tenkan-Sen) and any break below will drag the pair down till 1.2940/1.2927/1.2860 (61.8% retracement of 1.2765 and 1.30244).

It is good to buy on dips around 1.3030 with SL around 1.2980 for the TP of 1.3080/1.31475