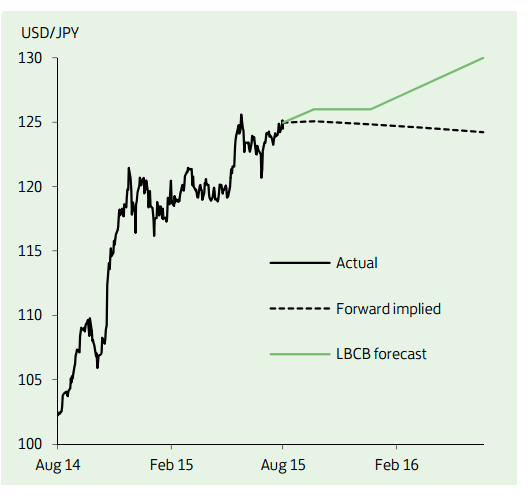

USD/JPY continued to trend higher for much of the past month, reaching an intra-month peak of 125.28 following the devaluation of the yuan earlier this week. At the time of writing, however, it has broken below 124, with the yen attracting renewed support from a flight to safe-haven assets amid the rise in global market volatility. More generally, concerns over the health of the Japanese economy continue to impact on the yen's outlook.

Upcoming GDP data are expected to show that Japan's economy contracted in Q2, while the latest fall in July consumer confidence to a six-month low suggests the consumer sector is showing no signs of improvement in early Q3. While BoJ President Kuroda recently played down the economic weakness and reaffirmed that its 2% inflation target would be reached, it is believed that the risks remain to the downside and further policy stimulus is likely to be required.

"The divergence in the outlooks for both US and Japanese growth and monetary policy are likely to see a renewed move higher in USD/JPY. We have revised up our forecast and now target 126 by end Q3," says Lloyds Bank.

USD/JPY Outlook

Wednesday, August 12, 2015 9:23 PM UTC

Editor's Picks

- Market Data

Most Popular