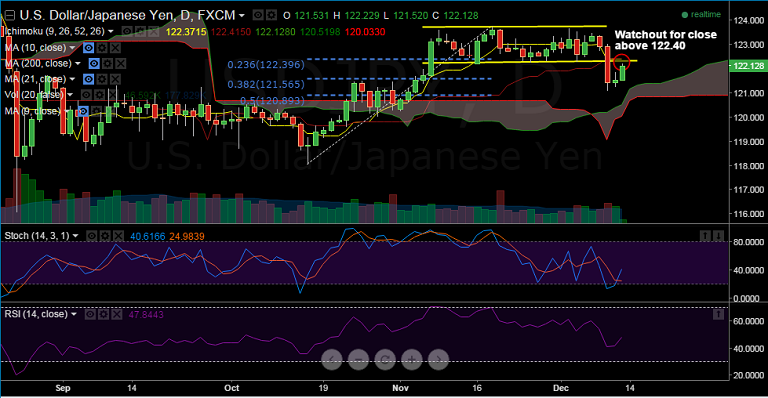

USD/JPY is extending its recovery from Monday's extensive slide, and has edged above 200 DMA at 121.58.

- Solid rebound staged by the Japanese stocks, which helped improve investors' sentiment helping the pair higher.

- Upcoming Fed hike also underpins the USD, markets now await a host of key US economic updates due later today for further direction in the pair.

- USD/JPY is curently trading at 122.14, with immediate resistance seen at hourly cloud top at 122.23, while support on the downside is located at 121.58 (200 DMA).

- A close above 122.40 could take the pair higher to 123.70 levels, but close below 200 DMA at 121.58 could see retrace to 120.89 levels.

- We would wait for breaks and close above 122.40 to go long.

Resistance Levels:

R1: 122.23 (hourly cloud top)

R2: 122.38 (Tenkan-Sen)

R3: 121.99 (38.2% Fibo 123.48-121.08)

Support Levels:

S1: 121.58 (200 DMA)

S2: 121.56 (38.2% Fib of of 118.07-123.77 rise)

S3: 121.24 (Dec 10 lows)

Kiwi Bulls Charge: NZDJPY Targets 94 as Yen Momentum Fades

Kiwi Bulls Charge: NZDJPY Targets 94 as Yen Momentum Fades  ETH Pulls Back to $ 2,020 After $ 2,200 Spike – Buy-the-Dip Setup Emerging?

ETH Pulls Back to $ 2,020 After $ 2,200 Spike – Buy-the-Dip Setup Emerging?  FxWirePro: AUD/USD downside pressure persists as risk aversion reigns

FxWirePro: AUD/USD downside pressure persists as risk aversion reigns  FxWirePro: GBP/USD downside pressure builds, key support level in focus

FxWirePro: GBP/USD downside pressure builds, key support level in focus  FxWirePro: USD/ZAR uptrend loses steam, remains on bullish path

FxWirePro: USD/ZAR uptrend loses steam, remains on bullish path  Aussie-Yen Deadlock: AUDJPY Braces for Potential Breakout Toward 112

Aussie-Yen Deadlock: AUDJPY Braces for Potential Breakout Toward 112  FxWirePro:NZD/USD under pressure as Middle East war escalates

FxWirePro:NZD/USD under pressure as Middle East war escalates  FxWirePro: GBP/NZD down trend loses steam, remains on bearish path

FxWirePro: GBP/NZD down trend loses steam, remains on bearish path  Aussie Charge: AUDJPY Surges 100 Pips as Bulls Eye 112.00 Milestone

Aussie Charge: AUDJPY Surges 100 Pips as Bulls Eye 112.00 Milestone  FxWirePro: USD/CAD dips as Canadian dollar gains on oil surge and soft U.S. payrolls

FxWirePro: USD/CAD dips as Canadian dollar gains on oil surge and soft U.S. payrolls  FxWirePro: EUR/AUD drifts lower, could be on verge of bigger drop

FxWirePro: EUR/AUD drifts lower, could be on verge of bigger drop  FxWirePro: GBP/AUD recovers slightly but bias is still bearish

FxWirePro: GBP/AUD recovers slightly but bias is still bearish  Bitcoin’s Institutional Tug-of-War: Geopolitical Tensions Clash with USD 920 Million ETF Surge

Bitcoin’s Institutional Tug-of-War: Geopolitical Tensions Clash with USD 920 Million ETF Surge  NZDJPY Range Breakout Watch: Bulls Target 94.00 as Technical Consolidation Tightens

NZDJPY Range Breakout Watch: Bulls Target 94.00 as Technical Consolidation Tightens  FxWirePro: USD/JPY edges up, remains on front foot

FxWirePro: USD/JPY edges up, remains on front foot  FxWirePro- Major European Indices

FxWirePro- Major European Indices