The yen gained while equities dropped sharply in Japan on Thursday, the first time stock markets had opened since Friday in the Asian nation.

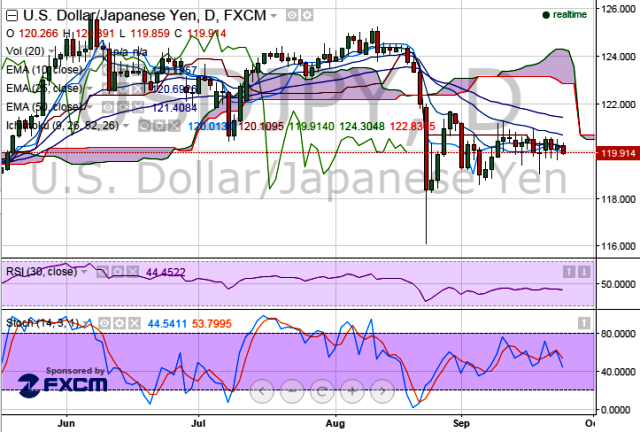

The USD/JPY pair fell 0.30% to ¥119.90 on Thursday morning in Tokyo, from ¥120.26 at the close of trade in New York on Wednesday, hitting an intraday low of ¥119.85.

Japan's benchmark Nikkei 225 index shed 2.29% to trade at 17,656.36 points before the lunch break in Tokyo, while the broader Topix gauge tumbled 1.80% to 1,436.03 points, heightening risk aversion and boosting the Yen.

Traders shrugged of Japan's Nikkei Manufacturing Purchasing Managers' Index (PMI), which fell from 51.7 in August to a preliminary 50.9 this month. Analysts expected the index to read 51.2 in September, however, the index held above the 50 mark, which indicates that the industry remains in expansion.

We prefer to take short position on USDJPY, Entry 120.15, Stop Loss 121.31, and Target 118.60.