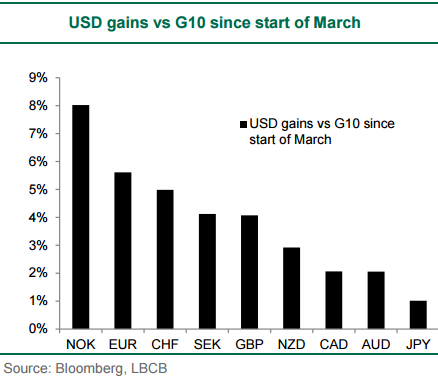

The FOMC meeting will be the main market focus today. USD strength has been relentless pretty much across the board since the start of the month.

The recent renewed optimism towards the USD centres on growing expectations that the FOMC will change its forward guidance at the today's meeting.

Lloyds Bank notes...

- We believe our base case scenario that 'patient' will be dropped is largely priced in.

- While this may prompt a modest pullback in the USD on a 'buy the rumour sell the fact' effect, this change in language could prompt the market to price increased risks of a June rate hike, suggesting upside risks for the USD, but this would be somewhat dependent on Yellen's comments.

- If in the event the FOMC drops the 'patient' statement but reveals an outright dovish tone, this is likely to prompt a sustained moderate pare back of recent USD gains, while if the FOMC retains the 'patient' statement, this would trigger a more meaningful reversal of USD recent gains.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX