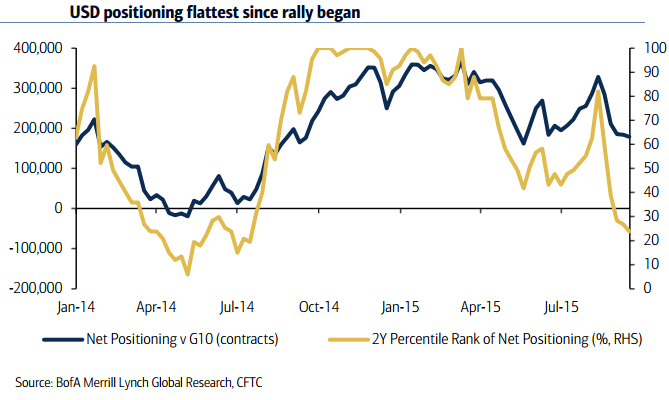

Despite the dovish response to the Fed's no-hike last week, some context on positioning is important, and could shed light on the USD's outlook. Since the USD rally began in mid-2014, stretched positioning has been a common refrain for those looking to avoid re-loading USD longs. USD long positioning is now at its lowest level since the dollar rally began.

Investors still maintain a net long USD positioning, but the 2Y percentile rank of speculative positioning is at the lowest level since July 2015. Not only are speculative investors less long the USD but longer-term buy and hold investors have also pared back positions. The pullback, while understandable given the fact the USD has been largely range-bound in recent months, could provide an opportunity with macro fundamentals continuing to support Fed hikes.

USD long positioning at its lowest level since the dollar rally began

Tuesday, September 22, 2015 8:23 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX