After a brief respite in early 2015, the dollar resumed its rise, pushing the total appreciation since June 2014 above 15%, with the recent rise occurring against emerging market currencies.

China comprises just under half of the emerging market index and dominates the share of nonautomotive consumer goods imports from the US.

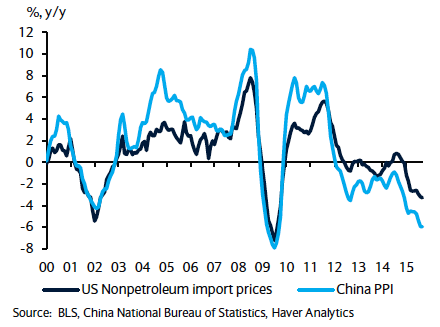

However, yuan appreciation does not fully reflect the disinflationary pressures arising from weak Chinese activity, producer prices and the evolution of raw materials prices and other intermediate inputs to Chinese production also influence the evolution of import prices from China.

As the chart shows, changes in producer prices in China have long been associated with changes in US import prices. Thus, the recent acceleration in Chinese producer price deflation poses a risk to US import prices.

"Some downward pressure had been incorporated on import prices into the baseline inflation forecast, but downside risks to US prices remain", says Barclays.

USD strength to weigh on tradable goods prices

Tuesday, October 20, 2015 5:38 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed