From this month, additional easing from European Central Banks (ECB) has kicked in and the central bank is now purchasing assets in tune of €80 billion worth of assets roughly from this month onwards. Biggest of the changes has been introduction of no-bank investment grade Euro zone corporate bonds into the purchase basket, which not only have reduced yields but increased new auctions from corporations too. Last month €50 billion worth of fresh buying eligible bonds have hit the market.

With better funding for corporates and improved retail level demand, it is more likely that unemployment rates will drop further. However, real move once again will be on the narrowing of spreads, which actually remain key challenge.

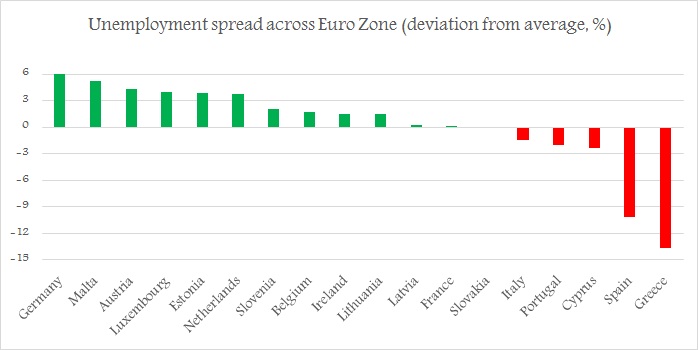

It will be easier for European Central Bank (ECB) to conduct monetary policies, with relatively homogenized unemployment rates across Euro Zone. Euro Zone policymakers, should pursue reforms not only reduce their deficits but to conduct fiscal policies such way that level of employments are more aligned.

As of now, while countries like Germany, Malta, Luxembourg, Estonia outperforming, Spain and Greece is still far away from recovery. However good news is that spread has reduced in countries like Italy, Portugal and Cyprus.

Expect further improvements in the spread, however Greece is still likely to remain as out layer.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX