Abe needs to persuade Trump next week as the US president Trump mentioned during a meeting with pharmaceutical company executives in last week that “They [China and Japan] play the devaluation market.”

In a press conference, BoJ governor Kuroda responded that the BoJ’s aggressive easing, the first arrow of Abenomics, is not intended to devalue the yen. The official view from the BoJ and the government is that Japan’s monetary policy is targeting neither the level of JPY nor stability of the currency market, as stated. Prime Minister Abe also emphasized this point in the Diet session.

However, they must certainly remember the political pressure from the US that led to the rapid JPY appreciation in the early 1990s (see our FX research team’s “Japan-U.S. trade frictions and the yen, Lessons from the early 1990s”).

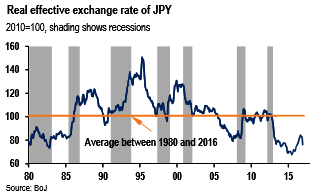

We note that the real effective JPY exchange rate was not a slow then as it is now (see above chart). This means that the US may have more grounds for the statement now, though what the US government would do is uncertain. Abe will visit Trump next Friday with the minister of finance, who is in charge of currency policy.

They probably will attempt to persuade the administration that Japan is not a currency manipulator and is in fact contributing to US job creation through foreign direct investment. Trump’s reaction may cause market volatility, which would raise the risk that business confidence will start to deteriorate.

While BoJ stood on hold as widely anticipated; autopilot likely would continue at least until H2 of this year. The Japanese central bank delivered no surprises at its policy meeting this week, leaving in place the parameters of its yield curve control policy (-0.1% for the IOER and the around -0% target for the 10-year JGB yield) and of asset purchases, including the about ¥80 trillion per year for JGBs. In any event, we think it is still too early to talk about a policy change.

In fact, the BoJ revised up its growth forecast but left the inflation projection unchanged (and very high compared to our and the market consensus forecast), implying that their inflation outlook has become somewhat cautious. More importantly, their risk bias for both growth and inflation skews to the downside. We continue to believe the BoJ will stay on hold at least for the next six months, if not longer.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty