This week the prime minister entered full marketing mode.

Scott Morrison’s topic was climate change and his plans to get to net-zero.

At the Victorian Chamber of Commerce and Industry on Wednesday, he tried out a few slogans.

Among those he test marketed:

-

can do capitalism, not ‘don’t do governments’

-

no one passed a law or introduced a tax or passed a resolution at the UN that led to the world developing a COVID vaccine, no one passed a law for the world to move digital, Google and Cochlear were not invented at a UN workshop or summit

-

Australia has already reduced our emissions by more than 20%, now, our emissions are going down, not up, they’re down by more than 20%

He said a bunch of other stuff, but those are my top three.

He wants to contrast his approach with certain United Kingdom and US environmentalists, who do indeed want to restrict what people can buy or do. Ideas like mandatory “meatless Mondays” and banning advertising for SUVs do indeed have no place in Australia, or even in the UK for that matter.

And nor does telling people where to drive, although the prime minister assured us he was not going to tell people “where to drive or where they can’t drive.

Economists don’t like such ideas either. The whole idea behind a price on carbon (whether through a carbon tax or a system of tradable permits) is to respect people’s preferences, while making sure their decisions take account of the costs they impose on others.

Innovations often come from government

His second claim was that innovation (things like the COVID vaccine, Google search and digitisation) isn’t sparked by governments.

While it’s true that "Google and Cochlear were not invented at a UN workshop or summit”, to suggest that governments played no role is to wilfully ignore history.

The miraculous Moderna mRNA vaccine was developed… checks notes… in partnership with the US National Institutes of Health. Moderna received nearly US$10 billion in taxpayer funding.

Much of the work on the Cochlear ear implant was done at the largely government-funded University of Melbourne; the internet revolution grew from the US Department of Defense’s Advanced Research Projects Agency; and Google’s search algorithm was developed by fully-funded graduate students at Stanford University, whose endowment is tax exempt.

Very often, cuts in emissions come from government

Morrison emphasised on Wednesday that Australia has reduced emissions by 20%.

It’s natural to ask what brought it about. Much of it was a cutback in land clearing, which is counted as emissions reduction under the rules. Land clearing is regulated by government.

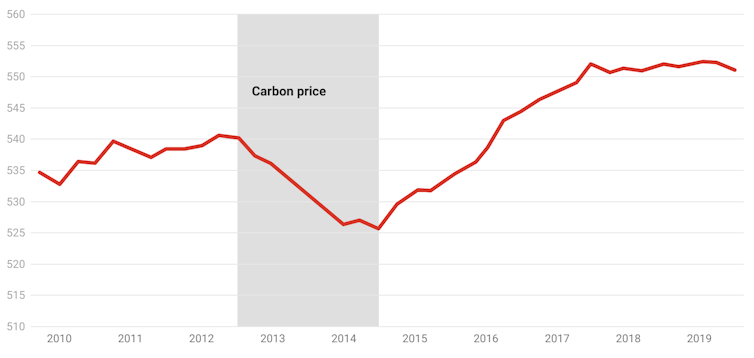

Much of the rest happened during the two years Australia had a carbon price in place, as this chart shows.

Australian emissions excluding land use, land-use change and forestry

Million tonnes of carbon dioxide equivalent per annum, updated quarterly. Climate Council, Department of Industry

The claimed 20% reduction owes much to the laws and summits the prime minister derides.

All prime ministers are politicians, so isn’t surprising they spin narratives. But to spin one so sharply at odds with reality is surprising.

When it comes to “technology not taxes”, the truth is it is often taxes that drive the development and uptake of technologies.

Importantly, taxes don’t specify the particular technologies that will emerge.

Perhaps that’s why the nation’s peak body for can-do-capitalitsts – the Business Council of Australia – has asked the government to subject more businesses to Australia’s existing little-known (weak) price on carbon.

If we are going to get to net-zero, we need less marketing and more markets. Now there’s a slogan.

Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment

Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment  Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran

Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran  Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand

Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand  U.S.-Canada Trade Talks Resume as Trump Administration Reviews USMCA

U.S.-Canada Trade Talks Resume as Trump Administration Reviews USMCA  BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data

BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data  Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty

Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty  Tokyo Core Inflation Slows Below 2%, Complicating BOJ Rate Hike Outlook

Tokyo Core Inflation Slows Below 2%, Complicating BOJ Rate Hike Outlook  Oil Prices Steady as US-Iran Nuclear Talks and Rising Crude Inventories Shape Market Outlook

Oil Prices Steady as US-Iran Nuclear Talks and Rising Crude Inventories Shape Market Outlook  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  IMF Urges U.S. to Cut Fiscal Deficit to Reduce Trade and Current Account Gaps

IMF Urges U.S. to Cut Fiscal Deficit to Reduce Trade and Current Account Gaps  Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure

Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure  Australia Inflation Rises Above Forecast in January, Fueling Interest Rate Hike Concerns

Australia Inflation Rises Above Forecast in January, Fueling Interest Rate Hike Concerns  Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA

Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA  U.S. Stocks Rally as Nvidia Earnings Loom, Oil Prices Near Seven-Month Highs

U.S. Stocks Rally as Nvidia Earnings Loom, Oil Prices Near Seven-Month Highs  Gold Prices Steady in Asia, Set for Strong February Gains on Safe-Haven Demand

Gold Prices Steady in Asia, Set for Strong February Gains on Safe-Haven Demand  MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains

MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains