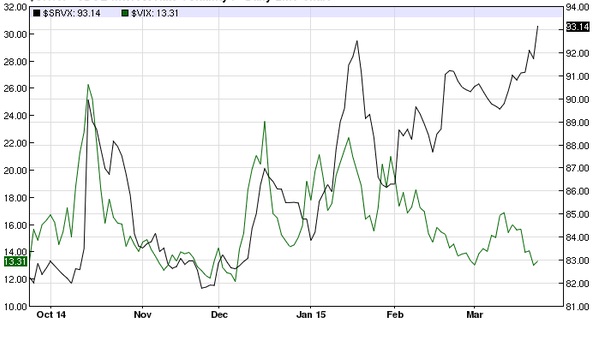

The chart attached represents CBOE $VIX that measures volatilities in US stock market and $SRVX that measures volatility in interest rate market.

What is $ SRVX?

- The CBOE SRVX Index is based on 1 year swaptions on 10 year U.S. Dollar interest rate swaps, a benchmark for the USD interest rate swap market. It measures the basis pints volatility of the forward swap rate as opposed to percentage changes in the rate, as done for VIX.

Key observations -

- Market still remains concerned over first rate hike by US Federal Reserve and is not coming to a general consensus over the probable path of rate increase.

- Dovish comments from FOMC successfully reduced VIX, which is also considered as fear gauge from around 17% to current just above 13.5%. However interest rate market remain cautious as volatility rose 82 basis points in December to above 93 basis points as of now.

Since market is yet to set sight over probable rate hike path, volatility and uncertainty over further rise in US dollar is here to stay for now. US dollar is trading at 97.07, down 0.3% today. US benchmark 2 year yield is hovering around 0.57%, down from its recent high around 0.70%

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate