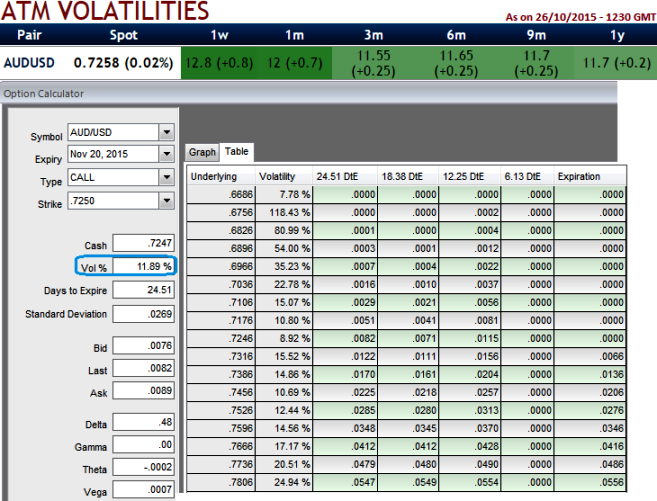

Firstly, let's have a glance on IV nutshell of AUDUSD, it is quite regular market practice to recapitulate the information in sequence of the vanilla options with no hedge scenario in the volatility smile table which includes Black-Scholes implied volatilities for different maturities and moneyness levels.

The degree of moneyness of an option can be corresponded to the strike or any linear or non-linear transformation of the strike. (Forward-moneyness, spot-moneyness, delta).

The implied volatility as a function of moneyness for a fixed time to maturity is generally referred to as the smile.

The volatility smile is the crucial object in pricing and risk management procedures since it is used to price vanilla, as well as exotic option books.

For an instance, AUDUSD ATM vanilla option has IV at almost close to 13% for 1w-1y maturities, but has been plummeting gradually to 12% over the period, also on a strategy or of different strike it certainly varies.

When we've chosen a slightly out of the money strike put considering delta risk reversal computations the volatility has also been inched up at 9.71%.

This is basically because market participants order flows do not expect the direction the strike price that is chosen.

That is because the market participants entering the FX OTC derivative market (heterogeneous) are confronted with the fact that the volatility smile is usually not directly observable in the market.

This is in opposite to the equity market, where strike-price or strike-volatility pairs can be observed.

Volatility smile varies with strikes – a glimpse on AUD/USD volatility skew

Tuesday, October 27, 2015 12:29 PM UTC

Editor's Picks

- Market Data

Most Popular