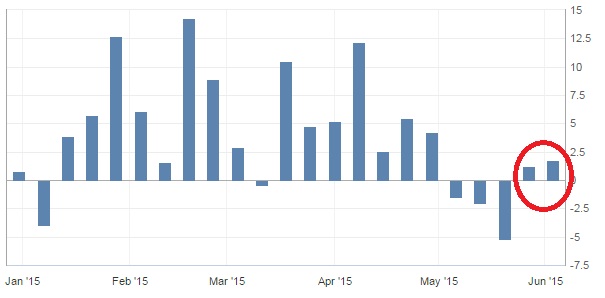

WTI is struggling to gain above recent doji high of $62.57. Since the Doji appeared in the chart, WTI has given almost $6 correction and bounced back last week on Wednesday as EIA crude stock surprisingly shrank.

- Last week's data was of particular surprise. Inventory shrank by 2.8 million barrels against an expectation of 2 million barrels. Moreover according to American Petroleum Institute (API) crude inventory grew by 1.2 million barrels.

Today API reading showed, Inventory rose by 1.8 million barrels for the week. Market is now awaiting data from Energy Information Administration (EIA). Crude stock shrinkage by 2 million barrels expected today.

Today data if surprises either way, might push WTI for a breakout.

WTI is currently trading at $60.7/barrel.

Price is evenly priced and move might occur at any direction.

- After API's positive inventory report, EIA inventory once again shrinks, WTI will breakout above $62.75 and move towards its next target area of $70-75.

- Downside break might not come easily as weaker dollar is providing support and OPEC is holding summit in Vienna.

Downside target for WTI is around $50-$52 area, if doji high is not taken out.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary