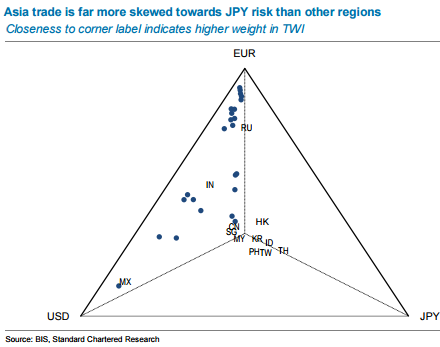

To refresh that analysis, the relative balance of trade for all countries between the US, euro area and Japan are shown in the figure. For countries in Europe or with close geographic ties to Europe, exposure to the euro area is clear; similarly, for Canada and Mexico, the strong bias towards the USD is evident.

For Asian economies, the balance is far more even across all three markets, with a general bias towards a heavier Japan weighting. In an environment of a weakening JPY, the same issues of strengthening trade-weighted exchange rates resurface.

Recent export data for South Korea, Taiwan, China, India, Indonesia and Thailand has shown continued contraction y/y, while Japanese exports have strengthened over the same period. Trade and current account balances have been more stable in Asia, but this has been primarily a consequence of import contraction and representative of slowing domestic activity.

The temptation for central banks is therefore to weaken exchange rates and engage in currency wars to support export activity. This is not straightforward, however, because of the risks from stock imbalances. More recent data allows to refresh the analysis, and to understand whether some of the vulnerabilities identified have improved, says Sthandard Chartered in a report on Wednesday.

Stnadard Chartered takes the international investment position (IIP) data from the IMF, and makes several adjustments as follows.

- First, strip out reserve assets, as interested in assessing the dynamics of the private sector.

- Second, strip out foreign direct investment through the equity channel, as analysts are concerned with potential vulnerabilities to reversals, then look at a range of metrics, including the USD change post-GFC in the net liabilities of the private sector. The bank also normalises this change and the stock of liabilities versus the stock of gross foreign assets and relative to GDP.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX