Bank of Japan (BOJ) launched Qualitative and Quantitative Easing (QQE) program back in late 2012, increased pace of purchase last year which lead to weakening of yen close to 40% against dollar and Nikkei to rise to 15 year high around 20000 level.

However, in terms of striking inflation towards projected goal of 2% and boost the economy to pre-crisis level the program remains a failure so far.

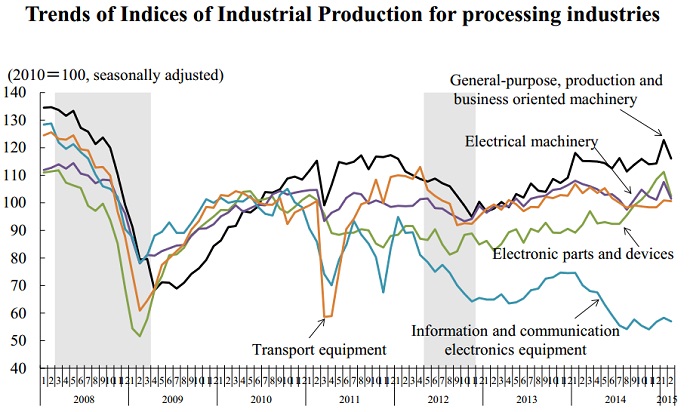

- Industrial production data released today for the month of February registered another contraction of -3.1% m/m and -2% y/y. industrial production index hit lowest level this year.

Evaluation of other industrial indicators paints similar picture -

- Production capacity remained flat in February, and much below pre-crisis level.

- Machinery industry index hit levels not seen since December 2013, however remains weaker than 2008.

- However manufacturing industry excluding machinery continue to slide lower.

- Operating ratio is down by 3.2% m/m. Bounced back since introduction of QQE, however still remains well below pre-crisis level.

Since 2008 crisis Japan has lost grip of its core traditional industries and started losing out to global players.

- Information and communication electronics equipment that used to rank highest, only second to production and business oriented machinery among processing industry has now moved below 2009 crisis low levels.

BOJ might move to a wait and watch mode before launching extension to the current program. BOJ might move ahead to increase portfolio coverage beyond bonds and REITs once the current Euro Rout gets done with.

Yen would continue to trade sideways until then, taking cues from risk aversion and dollar. Yen is currently trading at 119.6, down -0.10% today so far.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?