Ethena is a financial protocol built on the Ethereum blockchain, designed to provide a synthetic dollar solution that operates independently of traditional banking systems.

In mid-October, big investors bought around 5.4 million ENA tokens worth about $2.3 billion. This buying spree lined up with a price jump, as ENA rose by 96.6% during the month, bringing its market value to $1.14 billion.

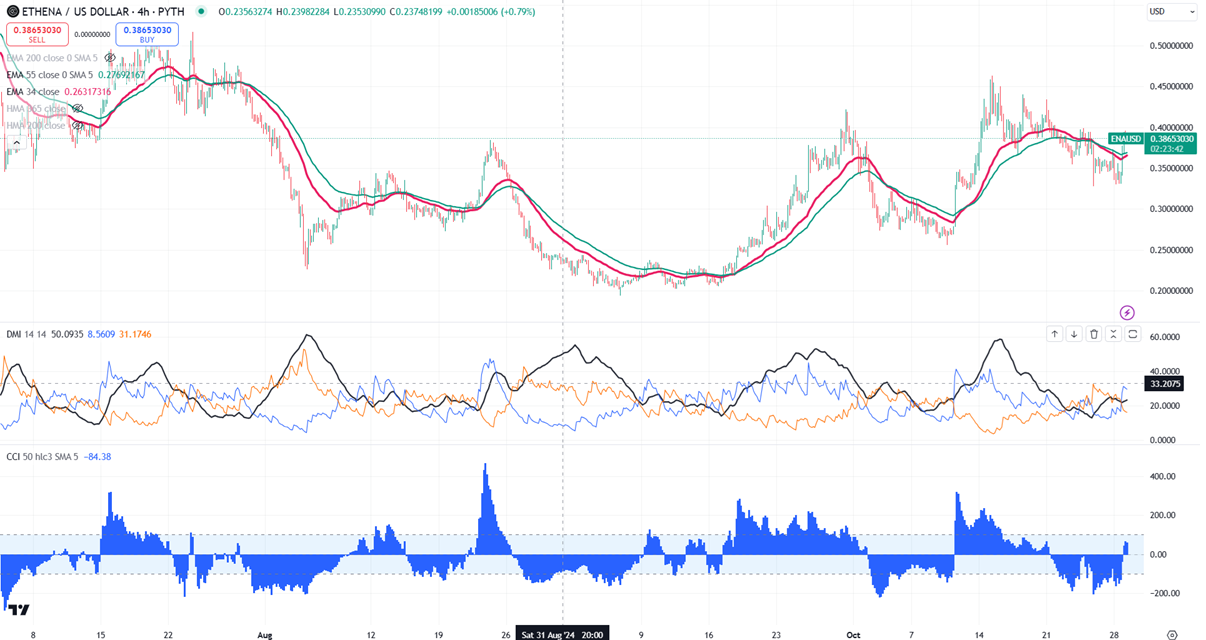

ENAUSD was one of the best performer in the past three days

Any daily close above $0.52 confirms further bullishness.

ENAUSD consolidating in a narrow range between $0.4650 and $0.3270 for the past two weeks. The pair holds well above the short-term (34 and 55 EMA) and long-term moving average. It hit a low of $0.3961 and is currently trading around $0.38605.

The bullish invalidation can happen if the pair closes below $0.260. On the lower side, the near-term support is $0.330. Any break below targets $0.300/$0.260.

The immediate resistance stands at around $0.4250. Any breach above confirms a minor pullback. A jump to $0.475/$0.5330 is possible. A surge past $0.5350 will take it to $0.6350/$0.7000.

It is good to buy on dips around $0.3500 with SL around $0.2600 for TP of $0.6350.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate