Last night, US Federal reserve release minutes of July meeting, which was perceived by the markets as dovish, since majority of the policymakers preferred waiting for further confirmation that economy has gathered enough pace to survive without FED lifeline.

Hence, Dollar is down and most of the major currencies are back trading in green for the week.

While almost every market participants are in search for clues, when FED might hike rates for the first time let's look at payroll numbers in Light of FED minutes.

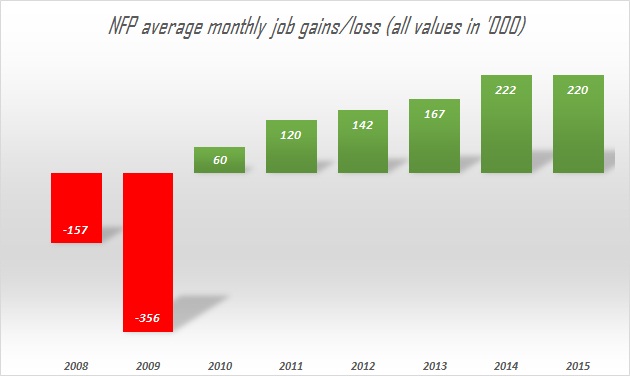

- The above chart clearly shows, that US labor market has improved substantially and continuing its improvement, in spite of setback in growth this year.

- In 2009, labor market worsened, with average monthly job loss touching -356,000. Since then US payroll numbers have solidified and continuing its gains for six consecutive year counting 2015.

- In 2014, average monthly job gains were roughly 222,000 and this year average has been 220,000 so far suggesting strong momentum.

So the key question stands, which payroll number should be sufficient for FED to hike rates or to refine which number should be considered good enough going ahead?

- The minutes, in spite of being considered as dovish, contains some bullish cues. In June and July payroll gains were 223,000 and 215,000 (before revision) and FED is considering this number as "SOLID".

So according to our view, since above mentioned numbers are solid, any number above 200,000 should be considered as very good and number below 175,000 can be considered as a bit disappointing.

While this solid numbers and even a FED hike is bullish for Dollar or not could be a matter of debate, which we will revisit later but it can be said with strong degree of confidence that FED is clearly on its way to hike rates this year, probably in September or October.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary