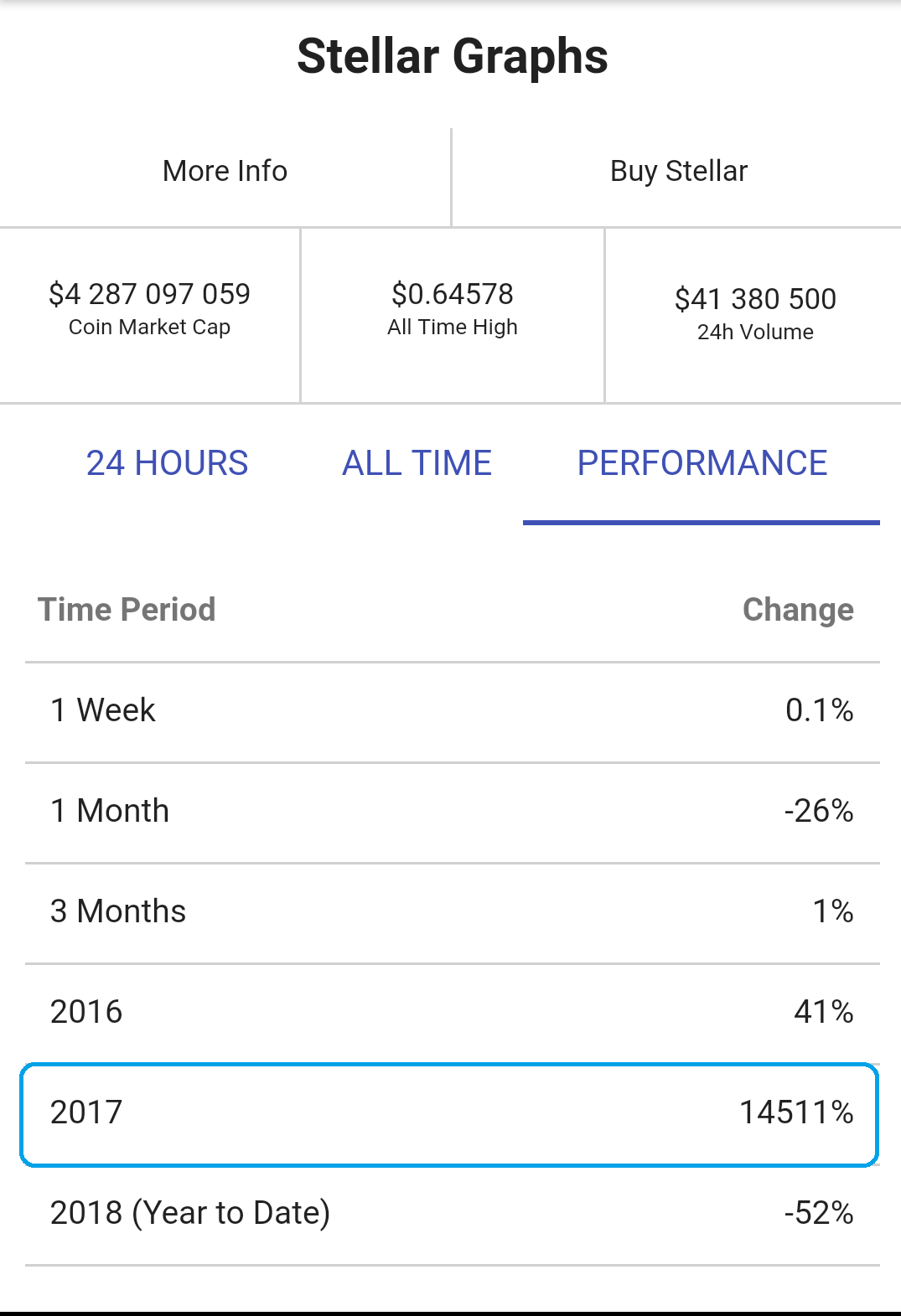

Cryptocurrencies have had a convincing bull run in the last year. But Steller (XLM) has shown sharp spikes that might have taken the investors to the Mars, Venus or some other planets. Yes, we aren’t blowing out of the proportion, just in 2017, this cryptocurrency has shown a mammoth over 14500% returns.

eToro has been the world’s largest investing platform, has published a market research report on Stellar and contemplating this research report and few other snippets, in this write-up, we are emphasizing on this crypto.

Stellar has built-in a commanding network with XLM as its network currency. Its core use case is analogous to that of a traditional fiat currency like euros or dollars, but with the advantages of a decentralized and secure online network. Stellar (XLM); the project to connect payment systems especially, banks quickly at almost no transaction cost. Stellar has achieved a lot in the past, including a partnership with IBM, however, the digital asset has been struggling in the crypto space.

As per eToro’s research report, we learned that ICOs have raised significant capital on Stellar. Stellar provides a faster and cheaper way of raising money for ICOs. Although it does not offer Turing-complete smart contracts like Ethereum, by far the most popular Blockchain for ICOs at the moment, Stellar can provide a faster and cheaper way of raising money for ICOs.

At over 1000 transactions per second, it is also more scalable than other popular Blockchains such as Bitcoin (5 transactions/sec) or Ethereum (20 transactions/sec). Key ICOs raised on Stellar include: Kik ($100M), Mobius (39M), SureRemit ($7M), Ternio (Sale TBC).

Despite Stellar’s value as a means of cross-border exchange, there is currently the little economic case for Lumens (XLM) tokens to rise in value.

A combination of low fees and high total supply of coins renders the velocity of the tokens insignificant.

Aside from providing liquidity for exchange markets, there is currently little incentive to use XLM as a store of value in addition to a means of exchange. Courtesy: eToro, coinmarketcap

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Visa Expands Digital Wallet Capabilities with Visa Commercial Pay

Visa Expands Digital Wallet Capabilities with Visa Commercial Pay  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Robinhood CEO Vlad Tenev: Blockchain Can Open Private Markets to Retail Investors

Robinhood CEO Vlad Tenev: Blockchain Can Open Private Markets to Retail Investors  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Alchemy Pay Forms Strategic Partnership with Worldpay to Expand Cryptocurrency Payment Channels

Alchemy Pay Forms Strategic Partnership with Worldpay to Expand Cryptocurrency Payment Channels  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation