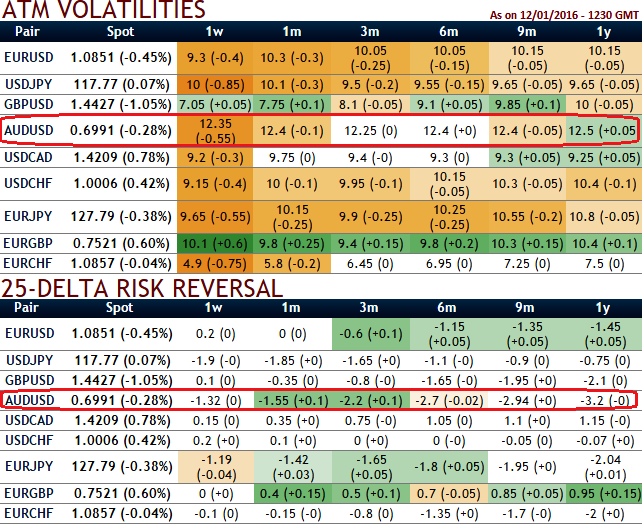

From the nutshell, one can make out AUD/USD is the pair to perceive highest IVs with most expensive puts for hedging downside risks.

These highly negative risk reversal numbers of AUDUSD with higher IVs shown in the nutshell are suggested to contemplate only during following circumstances:

- if you are disposed to assume approximate risk in return for the chance to exchange currency upon maturity at a better rate than the current forex forward rate;

- if you want to lock in a worse but still acceptable exchange rate just in case the exchange rate develops differently than projected by the customer;

- if you are unwilling to pay or want to reduce the premium payment as compared to those payable in case of forex options.

Now IV of the ATM contracts this pair is also higher with higher negative risk reversals, it means the OTC market sentiments are well positioned as the price has potential for large downward movement in next 1m or so.