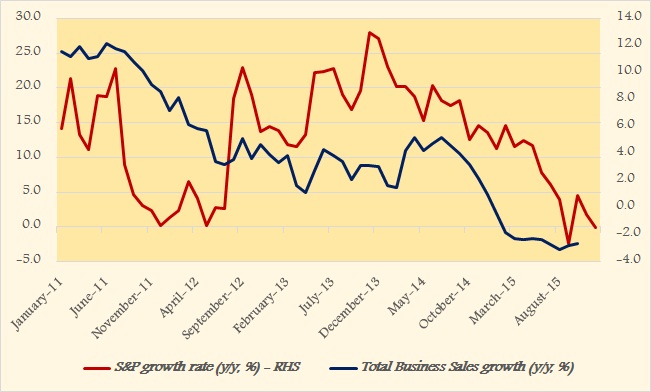

In previous part we discussed, though monetary policy from FED is very accommodative, but with even gradual tightening, stock market would finally fall to fundamentals. That is to move up in share price, it would need support of both top line and bottom line. Since 2011/12, S&P 500 has been diverging with growth in business sales and from mid-2014 it has been somewhat prominent as growth in TBS dropped to negative (and staying) this year.

However, inside this divergence do exist a form of convergence, which signals that S&P might finally be falling in line with fundamentals.

While the index has kept heading higher, growth rate in S&P has started converging with that of TBS and since mid-2014, this convergence is more prominent (shown in figure). But there is still some, which we expect to diminish with gradual tightening of FED policy.

Heading into 2016, S&P 500 seems vulnerable in absence of growth in economy and earnings.

Since monetary policy is well accommodative across globe, this eventual alignment to fundamentals is only to get delayed but remains inevitable.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022