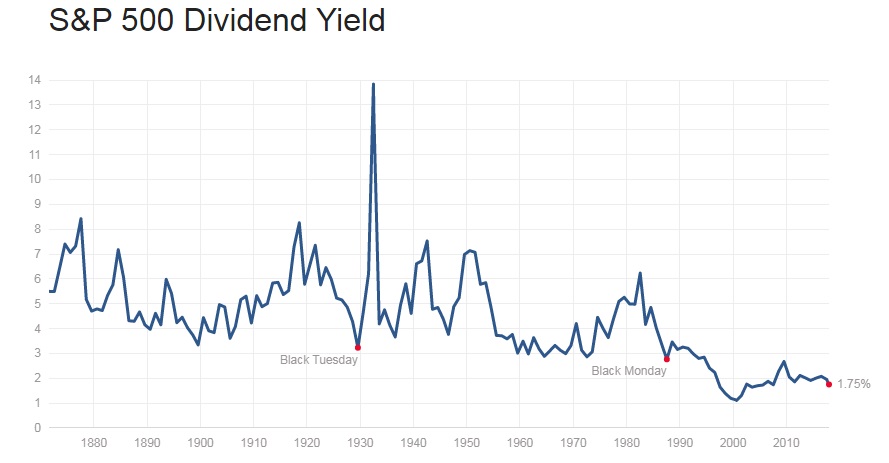

2017’s rally in the U.S. stocks is continuing well into 2018. However, some signs are emerging which suggests that stocks are becoming overvalued and a correction looks increasingly likely. In 2017, the U.S. benchmark stock index returned more than 19 percent and in 2018, they have returned 2.9 percent so far, which is quite remarkable. While the latest increase is being supported by the recent changes in the U.S. tax code, one indicator is strongly suggesting stock overvaluation despite the tax euphoria.

The above chart shows the historical S&P500 dividend yield. As of latest data, it has declined to 1.75 percent, the lowest level in more than a decade, while the recent rate hikes by the U.S. Federal Reserve has pushed the short-term rate (both1-year and 2-year) above the dividend yield. The dividend yield is widely used to calculate the future return from stocks.

As of today, the U.S. 1-year treasury is returning about 1.78 percent, while the 2-year treasury is returning about 1.97 percent. A further spike in yields and rate hikes could bring about a major correction in the stocks.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell