Japan's trade deficit likely to be at ¥829 bn in February, barely unchanged from the year earlier level (¥805 bn in February 2014).

As this year's Lunar New Year holiday was much later than usual, export data may have had a large influence. February's export growth is likely to have slowed to 5.2% yoy from 17.0% yoy in January mainly because exports were brought forward ahead of the Lunar New Year holiday. Meanwhile, import growth is likely to decrease 1.3% yoy in February after -9.0% yoy in January.

Societe Generale notes in a report on Monday as follows:

- Looking at three-month average data on a seasonally adjusted basis, the trade balance improved to ¥760 bn between November and January, beating the performance of the previous three-month period (August-October 2014) of ¥900 bn, confirming that the trade balance is improving.

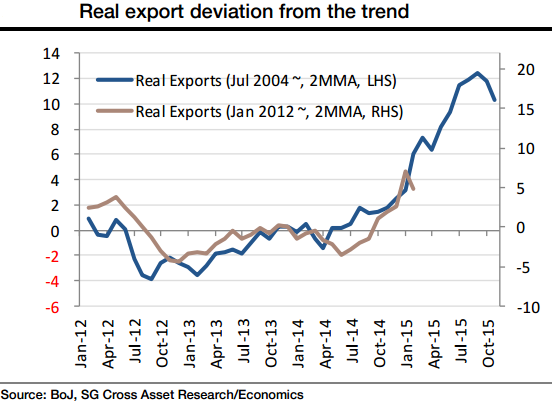

- The trend in exports appears to be outstripping that of imports, supported by rapidly declining oil prices, sliding faster than the pace of yen depreciation and also underpinned by the global economic recovery.

- In 2015, yen depreciation is likely not only to push up corporate profits but also exports, in volume terms.

- After confirming that exports are recovering in Q4, they are likely to help push GDP growthhigher in Q1 and thereafter. While we expect Q1 real GDP growth for 2015 to be 1.4%, the netexport contribution to 2015 real GDP growth is likely to be as much as +0.9 ppt.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022