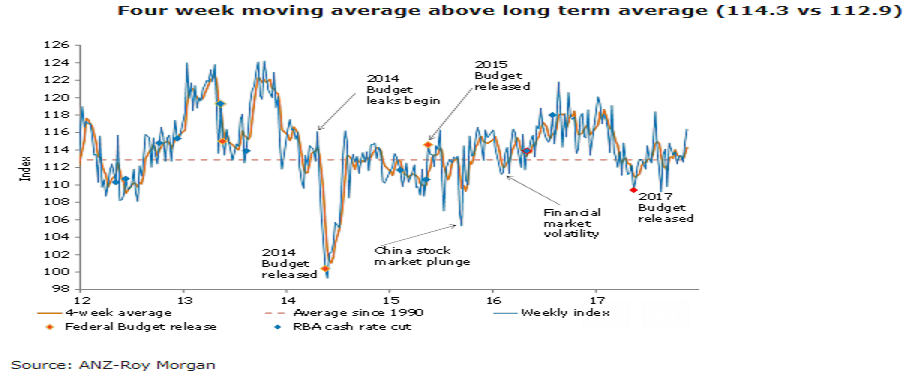

Australia’s ANZ-Roy Morgan weekly consumer confidence rose 1.4 percent last week to 116.4, its highest level in 16 weeks. The details were broadly positive, with three out of five sub-indices posting gains, while the other two showed only slight falls.

Households’ views towards both current and future economic conditions were up 2.9 percent and 2.0 percent respectively, following a solid 3.5 percent and 7.0 percent increase previously. Both sub-indices sit at multi-week highs.

Household views toward the state of their current finances slipped for the third consecutive week (-0.4 percent). Even so, current conditions remain well above their long-term average. Encouragingly, their views towards future conditions jumped 3.0 percent last week, the first increase in four weeks. Meanwhile, inflation expectations remained unchanged at 4.5 percent in four-week moving average terms.

"The outlook for employment in the near term remains positive, consistent with elevated business conditions and leading labor market indicators, and this should continue to broadly support confidence. However, last week’s weaker-than-expected wage growth is likely to weigh on consumers, particularly in the current environment of moderating house price growth and high household debt. Together, these factors are likely to cap the extent of improvement in sentiment," said Felicity Emmett, Senior Economist, ANZ Research.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022