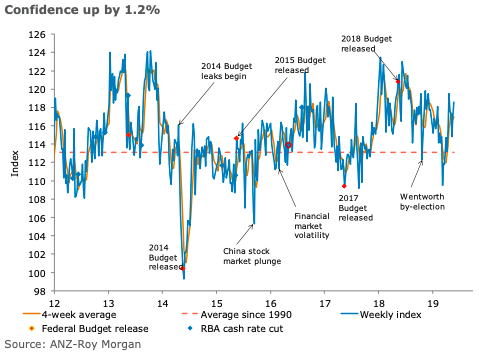

Australian ANZ-Roy Morgan consumer confidence continued to rise, gaining 1.2 percent last week. With the exception of ‘Time to buy a household item’, which fell 2.9 percent, all the sub-indices were positive.

Current financial conditions rose by 1.2 percent, while future financial conditions were up 0.8 percent. These two indices have risen for three consecutive weeks. The measure of current financial conditions is its highest since early February.

Current economic conditions rose 3.0 percent while future economic condition were up 4.5 percent. The four-week moving average for inflation expectations was stable at 4.1 percent.

"Consumers are upbeat about both their personal outlook and the economy in general. The prospect of lower interest rates and what appears to be a major sentiment shift on the housing market are likely drivers of the positive outlook. The gain comes despite negative developments in the global economy. While the four-week moving average for inflation expectations was unchanged at 4.1 percent, the weekly reading dropped back under 4 percent. This is the fifth sub-4 percent reading since early March, an unprecedented run of low results for this survey," said David Plank, ANZ Head of Australian Economics.

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom