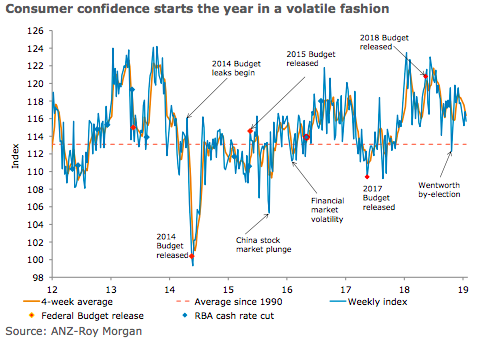

Australia’s ANZ-Roy Morgan consumer confidence was down 0.9 percent last week, giving back much of the prior week’s gain. The overall index is still above its starting point for 2019, though it is almost 5 percent lower than its average for January 2018.

Financial conditions declined, with current and future financial conditions falling by 0.3 percent and 2.4 percent respectively. Both indices are around the levels seen this time last year and above long-run averages.

Economic conditions were mixed, with current economic conditions gaining 3.4 percent while future economic conditions fell 0.7 percent. These indices are 6–8 percent below the levels that prevailed in January 2018. The ‘time to buy a household item’ index fell 3.2 percent. Four-week moving average inflation expectations declined by 0.1ppt to 4.2 percent.

"It has been a volatile start to the year for consumer sentiment, with the index displaying a down-up-down pattern, though encouragingly it remains above the long-run average. The global news is not helping, with China slowing and political developments in the UK and US dispiriting. Domestically the focus remains on the weak housing market, though as we noted in Friday’s Australian Macro Weekly the evidence of a wider negative impact is still quite limited. Employment will be the key domestic data event this week," said David Plank, ANZ’s Head of Australian Economics.

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances