Australia’s capital expenditure for the first quarter of this year fell lower than market estimates, driven by declines in construction and equipment, with both expected to detract from GDP growth in the quarter.

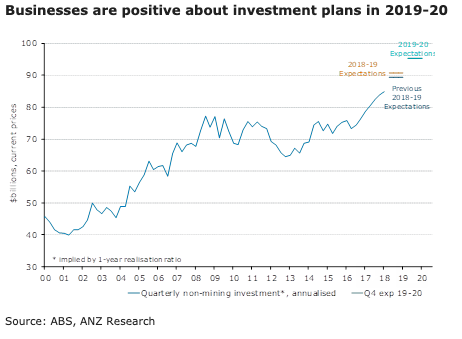

However, businesses maintained their positive outlook for 2019-20, with non-mining and mining firms planning strong increases in investment during the year, ANZ Research reported.

Capex fell 1.7 percent q/q in Q1 following a downward-revised 1.3 percent q/q increase in the previous quarter. Buildings and structures spending dropped by 2.8 percent, reversing the gain from Q4 2018, while machinery and equipment spending fell by 0.5 percent.

Capex plans for 2018-19 improved to AUD122 billion in Q1 from AUD118 billion in Q4. Non-mining firms now plan to increase investment by 9.4 percent in 2018-19, up from the estimate of 7.8 percent in Q4, while mining firms downgraded the expected fall in investment to -7.8 percent.

For 2019-20, capex plans were upgraded to AUD99 billion in Q1 from AUD92 billion in Q4 2018. Despite the latest capex survey occurring during a period of weaker business conditions, as well as global and domestic uncertainty, businesses appeared to maintain their positive outlook.

Both non-mining (+9.2 percent) and mining firms (+21.0 percent) are planning stronger investment during 2019-20. The downward trend in oil and gas investment is likely close to its trough, as work on Ichthys and Prelude nears completion, while iron ore investment is gradually building, the report further noted.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens