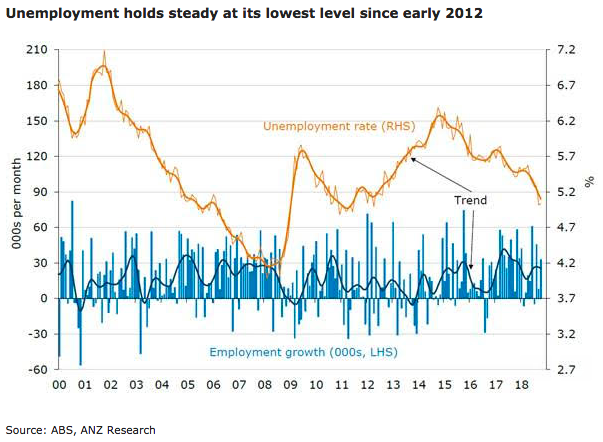

Australia’s unemployment rate held at a six-year low of 5 percent during the month of October, with no implications for the RBA, other than reinforcing the Bank’s bullish outlook, according to the latest report from ANZ Research.

The highlight of the October jobs report was the 42.3k gain in full-time jobs. While this was partially offset by a decline in part-time employment, the net result was a 33k increase in jobs that held the unemployment rate steady at 5 percent despite a higher participation rate. Confirming the strength of the report, hours worked rose 0.3 percent m/m.

Over the three months to October, a total of 86k jobs have been created, which is above the average rolling three month average of 70k for 2018 to date. Thus there is little evidence of a decline in the pace of job creation through 2018.

The underemployment rate was unchanged at 8.3 percent, meaning overall labour market underutilisation held steady at 13.3 percent. Employment growth was strongest in NSW, with a gain of 16k. The unemployment rate in NSW held steady at 4.4 percent, with only ACT lower at 3.7 percent.

Employment fell a touch in VIC, though this followed a strong gain in September, and the unemployment rate in VIC ticked down to 4.5 percent despite this drop. Employment also fell a bit in QLD, with the state unemployment rate rising to 6.3 percent.

Meanwhile, QLD’s unemployment rate has been 6 percent or higher since late 2017. SA, WA and TAS all gained jobs with their unemployment rates falling to 5.4 percent, 5.7 percent and 5.3 percent respectively. The unemployment rate in the NT rose to 4.6 percent, its highest level since September 2013.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment