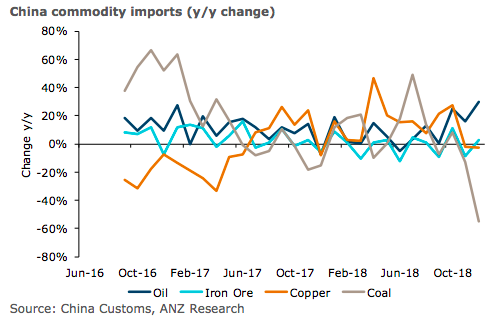

China’s commodity imports were mixed in December. Metals imports ended the year on a weak note, with copper down on a y/y basis. At the same time, imports of oil and natural gas remained strong. This suggests consumers remained cautious as trade tension rose in H2 2018.

"We expect this could turn around if talks ease the uncertainty, resulting in restocking of inventories in early 2019," ANZ Research reported.

Crude oil imports in December rose strongly, as refiners took advantage of higher refining margins amid a rush to utilise quotas before year end. Import volumes reached a record high of 43.8mt, bringing the annual growth rate to 10.1 percent. China’s ‘blue sky’ policy benefitted natural gas, with imports up 68 percent in 2018.

The ban on coal imports at certain ports resulted in volumes collapsing in December. However, with the ban being lifted in January, this weakness persisting for too long. Iron ore imports rose slightly in December (+3 percent y/y), matching anecdotal evidence suggesting steel mills in China are starting to restock ahead of the end of winter production curbs.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022