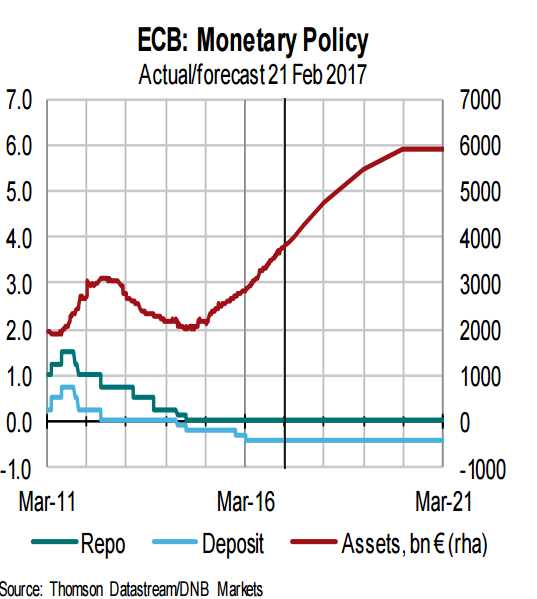

The European Central Bank (ECB) kept interest rates unchanged, including its €2.3 trillion bond-buying program but presented a brighter view of the eurozone economy. ECB president Mario Draghi sounded more upbeat about the effectiveness of the monetary policy. The central bankers acknowledged that the economic and inflation situation for the euro zone has improved.

The slight change in rhetoric from the ECB yesterday has taken a lot of negativity out of sentiment. The notably more upbeat tone in Mr Draghi’s assessment of economic prospects for the Euro area, even though there have been no corresponding upward revision to GDP growth forecasts in the ECB’s new projections suggests the ECB might slowly start to take small steps towards reconsidering its policy stance.

The ECB deleted from its communiqué the sentence stating that it was ready to use “all the instruments available within its mandate” in order to achieve its objectives. However, Draghi did everything to stop triggering expectations of rate hikes. He noted that the ECB has not dropped the option of another rate cut from its forward guidance. Draghi stressed that core inflation still hasn't risen, and central bank isn’t entirely convinced of a self-sustaining pick-up in inflation and still sees underlying inflationary pressure as weak.

The new ECB projections show a slightly firmer trend in ‘core’ inflation in 2018 and 2019 than previously envisaged. This brings core inflation to 1.8 percent in 2019, an outturn that is probably in line with the ECB’s definition of price stability. GDP growth for 2017 and 2018 are marginally stronger at 1.8 percent and 1.7 percent respectively. However, 2019 is still seen at a more modest 1.6 percent implying a slowing trajectory for economic growth in coming years.

"We suspect that this element of the forward guidance will be deleted in June. Furthermore, we expect gradual further tapering of QE from January 2018 with the asset purchases concluded in the second half of that year. And that would allow a first hike in the Deposit Rate in December 2018, with the Refi Rate not increased until 2019." said Chris Scicluna at Daiwa Capital Markets.

EUR appreciated by almost 1 percent against USD, but the reference to keeping the door open for further rate cuts is likely to have capped EUR appreciation. EUR/USD is extending gains on Friday, was up 0.32 percent at 1.0609 at 1150 GMT. The near-term resistance for the pair is seen around 1.06270 -1.06400 and any break above will take the pair till 1.06996 (61.8% retracement of 1.08288 and 1.04936)/1.07140. On the lower side, any weakness can be seen below 1.04900 and break below will drag the pair till 1.04530/1.03450 (Jan 1st 2017 low).

FxWirePro's currency strength index at 1150 GMT was as follows: Hourly EUR Spot Index was at 109.288 (Highly bullish) and Hourly USD Spot Index was at 83.4352 (Bullish). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand