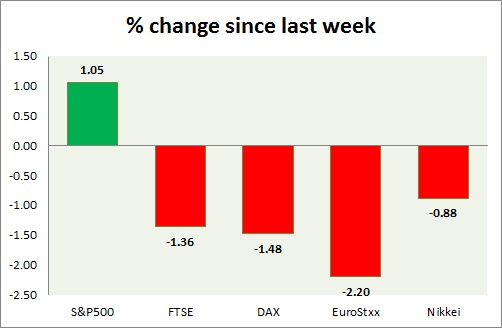

Equities are trading in consolidation, dovish FED failed to boost risk on as Greek drama weighs. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is treading above 2100 mark, boosted by dovish FOMC commentary. Today's range 2117-2090.

- Consumer price index (CPI) rose 0.4% m/m in May and failed to rise on yearly basis. Core CPI rose 0.1% m/m in May and 1.7% on yearly basis.

- S&P 500 is currently trading at 2116. Immediate support lies at 1980, 2040 and resistance 2164.

FTSE -

- FTSE has broken below key support area of 6700. Today's range 6700-6625.

- Retail sales grew 4.6% from a year ago.

- FTSE is currently trading at 6690. Immediate support lies at 6050 and resistance at 7000. 6700 area is likely to provide resistance.

DAX -

- DAX is trading with downside bias. Today's range 10800-11040.

- DAX is currently trading at 11030. Immediate support lies at 10730, 10500 and resistance at 11500 around.

EuroStxx50 -

- Stocks across Europe are all trading in green, bias remains downwards.

- Germany is up (+0.51%), France's CAC40 is up (+0.11%), Italy's FTSE MIB is up (+0.68%) and Spain's IBEX is up (+0.32%).

- EuroStxx50 is currently trading at 3428, up +0.53% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei is consolidating as Yen remains relatively stronger.

- Nikkei is currently trading at 20140. Key support is at 19500 and resistance at 20900 area.

|

S&P500 |

+1.05% |

|

FTSE |

-1.36% |

|

DAX |

-1.48% |

|

EuroStxx50 |

-2.20% |

|

Nikkei |

-0.88% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate