Since the bearish signals have been traced out from EOD as well as weekly charts, relevant hedging positions for Yen's exposure are highly recommended.

Formation of breakaway gap, hanging man & spinning top is figured out on GBP/JPY daily charts.

UK's current account deficit to widen; while Upward revision to Q1 GDP expected; Q1 GDP is projected to be revised up to 0.4% QoQ due to considerable revisions in construction output. In Q1, the current account deficit is expected to be pushed up from £25.3bn to £26.6bn on the back of a widening trade deficit.

We reckon markets for pounds dealing with yen would be bearish bias as a result of the technical and fundamental reasoning, we recommend arresting these downside risks of pounds through deploying below option strategy.

Option recommendation: Put Ratio back spread

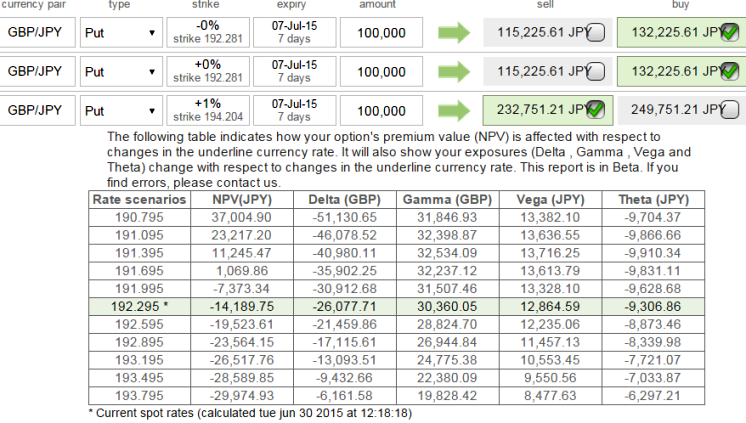

If expect the underlying currency (GBPJPY) to make the worrisome slumps, then purchase 2 lots of 7D At- The-Money puts each lot carrying delta at 0.5 and sell simultaneously an (1%) In-The-Money put with positive theta of the same maturity.

The combined delta should have -0.26. The higher strike short puts finances the purchase of the greater number of long puts and the position is entered for least cost.

Technically we don't think any further confirmation is required for Yen's gain, all chances of the pair to drag until 190 levels is pretty much clear to us with a strict loss at 195.

On hedging grounds, back-spreads using ATM puts are advised although the combination trading at higher premiums almost above 20% of NPV of the combined position.

We still reckon these positions are worth owning it as we foresee higher probabilities of Yen to gain against sterling.

However, kindly remember this must be added into portfolio as hedging perspective not for speculative reasons.

FxWirePro: GBP/JPY delta back-spreads costlier but worth holding to hedge pounds depreciation

Tuesday, June 30, 2015 7:10 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate