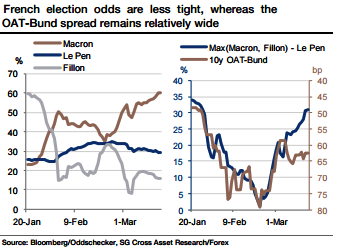

The political risk is tracked by the bookmakers odds, where the probability of a Le Pen win is stable around 30% (please refer above graph).

The medium/long-term impact on euro crosses highly depends on the materialization of a Frexit scenario. The impact of the French election is going to be extremely asymmetric on euro crosses, depending on the pro- or anti-Frexit outcome.

On the back these expectations, and in the aftermath of the Brexit vote and the Trump election, such a scenario cannot be qualified as a tail risk (unlike an actual Frexit). The OAT-Bund 10y spread has been closely following the spread between the winner’s odds and Le Pen’s odds (please refer above graph).

But there is now some risk premium in the bond market since Macron’s odds rose while the OAT-Bund spread did not materially tighten.

Indeed, there is much more volatility in Fillon and Macron voting intentions compared to Le Pen, keeping the market on guard.

All in all, the OAT-Bund spread should remain the best gauge for political risk and can be used to find the best FX hedge.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary