USD/NOK is a better short for higher oil prices than USD/CAD:

Better growth and the possibility of monetary policy divergence... The Canadian economy is struggling in the aftermath of the shale-oil boom’s end.

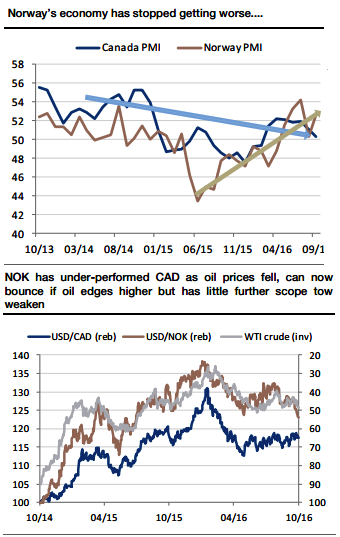

The manufacturing PMI has been falling for 6 months and employment growth has slowed to 0.6% per annum. Rates are low 50bp) but are likely to remain anchored even if the Fed hikes in December.

By contrast, the Norwegian economy is stabilising. The PMI is picking up and even if unemployment continues to trend higher, a shift away from falling investment in the petroleum sector to a pick-up in exports and a tailwind from the housing is helping the 2017 outlook.

This leaves the NOK better placed than the CAD to benefit from any further recovery in the price of oil and opens up the medium to longer-term, possibility of monetary policy divergence pushing CAD/NOK a fair bit lower.

Stay short in CADNOK at 6.0661 with the stop at 6.2259 (2.56%) and targets at 5.6 (7.68%) The carry almost exactly zero on forwards between 1-month and 1-year.

Risk-reversals were positively skewed by have fallen sharply, and volatility has picked up from summer lows, which makes a simple spot trade more appealing now than an option trade.

Risks: the only risks associated with above trade recommendation is that EURUSD slumps. There is a good long-term, correlation between CAD/EUR and EUR/USD where a falling EURUSD sees CAD out-perform NOK but in the last year, with more currencies rangebound, the r-squared on this correlation is just 0.05, so we worry about CAD outperformance only if we see EURUSD break below 1.06.

Is a Trump victory in the Presidential election partly priced in to USDCAD? It clearly is partly priced in to USDMXN, but the positive impact on CAD of a Clinton win is likely to be small.

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm