Polish real economy data for May, both industrial output and retail sales have underperformed expectations.

The industrial output was down 0.9%m/m in seasonally-adjusted terms compared with 2.4%m/m increase recorded the previous month; retail sales were down 0.7%m/m in May compared with 0.3% decline in April.

It is too soon to say whether the underlying activity trend is turning down or not, but this would be consistent with recent PMI behavior.

There was unusual seasonality this May which makes it difficult to get a good read of the data.

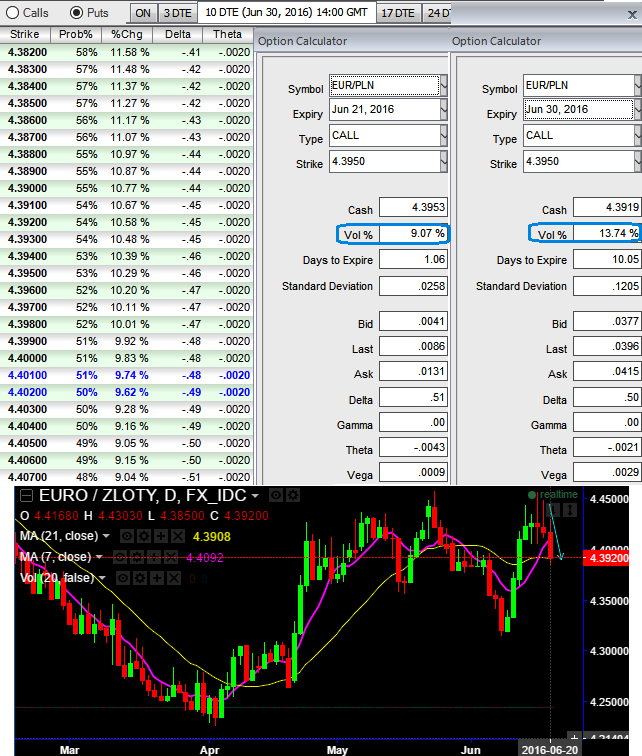

FX Option Trading Idea:

The current ATM IVs of EURPLN is moving in snail’s pace at 9.07% and creeping up above 13% for 10 days tenors.

While sensitivity tool signifies that the OTM strikes with higher probability numbers are most likely to expire in the money during this period, as theta suggests ATM options are risky to be written off on account of time decay.

The Theta of ATM options is higher and as time draws nearer to expiry, it increases. If you are holding an ATM option and expiry is approaching, you might be better off closing out of your position.

Go short in (1%) ITM call with shorter expiry (preferably 4D expiries)

Simultaneously, go long in 2w (1%) OTM +0.61 delta call.

Thereby, the position could be entered at a net credit, and the implied volatility as a function of moneyness for a fixed time to maturity is generally referred to as the smile.

The volatility smile is the crucial object in pricing and risk management procedures since it is used to price vanilla, as well as exotic option books.

OTM strikes, rely solely on extrinsic value and have a low Delta, Theta, and Vega. But a move towards the OTM territory increases the ATM Vega, Gamma, and Delta which boosts premiums.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate